EU Victims’ Rights Reform: A Missed Chance For Online Fraud Victims

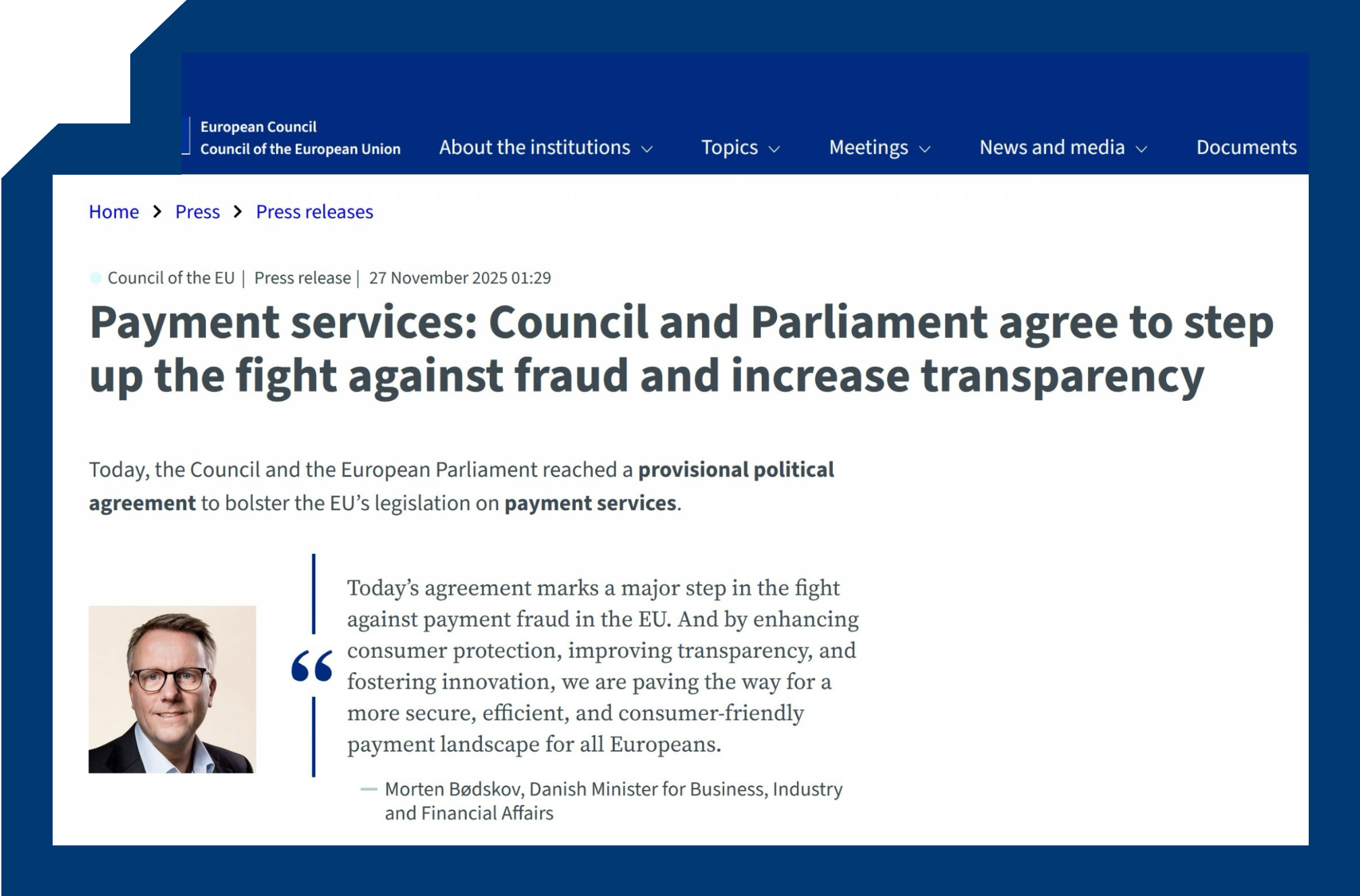

The revision of the EU Victims’ Rights Directive announced on 10 December 2025 is presented as a major step forward for crime victims in Europe, just like the new PSR/PSD3 package is sold as a breakthrough for payment users. But for online investment fraud victims, the reform is a missed