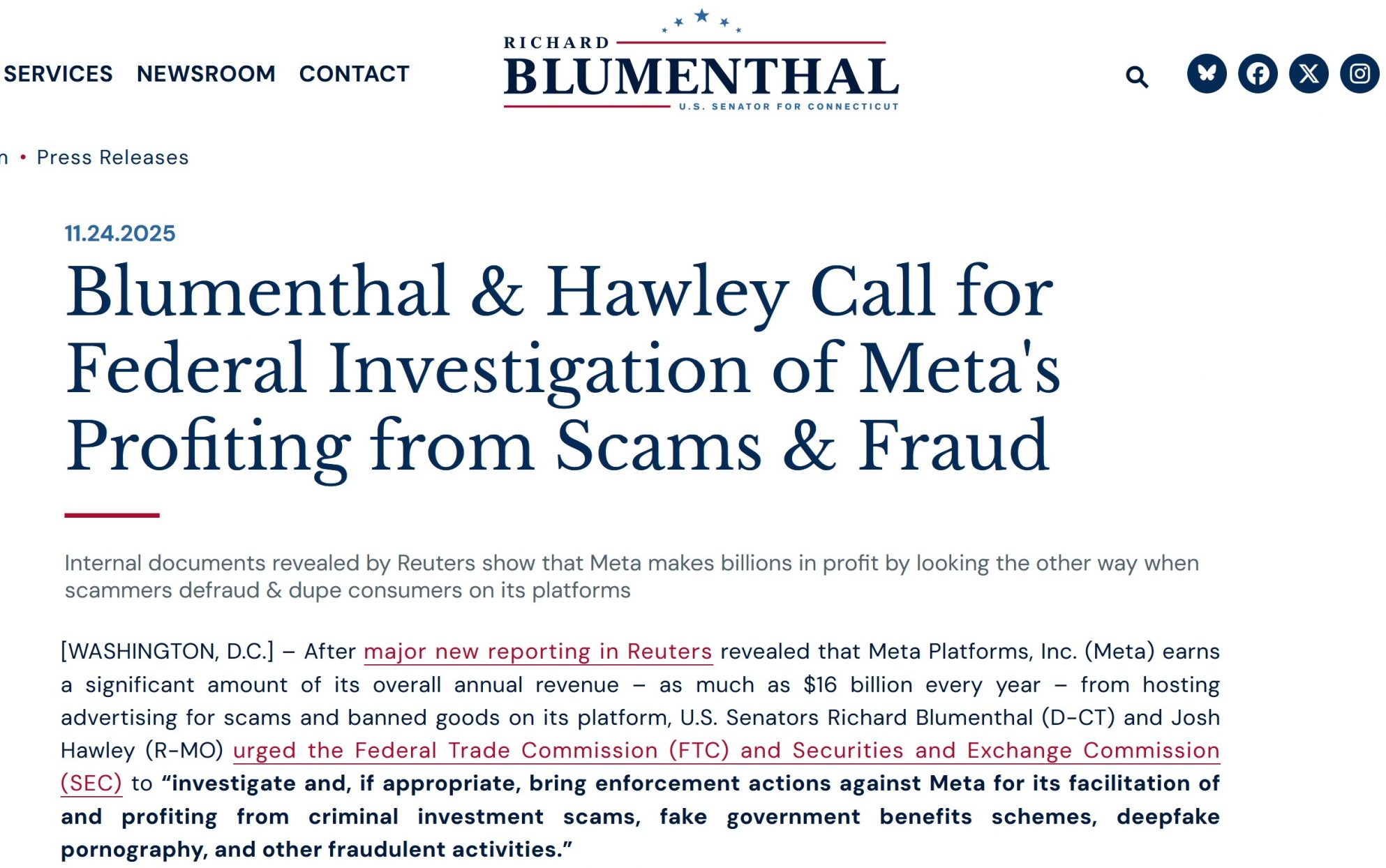

FRAML: The “Smoking Gun” That Proves the Need for Strict Liability

As the EU evaluates its “Fighting Online Fraud – Action Plan,“ a new emerging operating model is taking center stage: FRAML (the integration of Fraud and Anti-Money Laundering systems) to fight fraud real-time and more efficiently. At EFRI, we view FRAML as a double-edged sword. While it is a significant