In July 2022, the British FCA (Financial Conduct Authority) confirmed that it would be introducing a higher standard of customer protection, requiring regulated firms (including payment institutions and e-money companies) to put their customers’ needs first.

The new “Consumer Duty” rule consists of three elements:

- New consumer principle. The new Principle states “A firm must act to deliver good outcomes for retail clients”.

- Cross-cutting rules. The new rules requiring firms to act in good faith, avoid causing foreseeable harm and enabling and supporting retail customers to pursue their financial objectives will support the consumer principle and ensure firms meet the FCA’s expectation around cultures and behaviours.

- The “four outcomes”. There is a suite of other rules and guidance relating to the quality of firms’ products and services, the price and value of products and services, consumer understanding and support for consumers.

The FCA gave the firms twelve months, to take proper actions to meet the new “Customer Duty” rules. By 31 July 2023, the regulated firms have to implement the new rules – noted as the largest overhaul of British financial services of the last decade – as for all new and existing products and services that are currently on sale.

And we all know an overhauls of the British payment industry is overdue!

The UK is world-leading in the payments industry and the online fraud sector.

For years the UK payment industry lobbied the inaction of the British regulators and praised them for recognizing the creativity and the energy of a thriving fintech sector needed to maximize the economic and social benefits for the UK.

And at the first glance, this approach worked out quite well. The United Kingdom is finally leading the Western world in the payment sector. Since the launch of Faster Payments already in 2008, the UK’s vibrant market has become home to one of the most dynamic fintech sectors in the world.

The UK introduced Faster Payment (the equivalent of the upcoming Instant Payments in the EU and the US FedNow Service) in 2008. Approval of payment companies boomed in prior years resulting in more than 291 “innovative” payment companies (payment institutions and e-money companies (PIEMIS)) being registered with the Financial Conduct Authority in Great Britain, many more than in any other European country (even after the BREXIT transition period).

So the UK Finance “Payment Utopia” envisaging UK customers being able to make payments with the method that suits them, whether it is instant, single or bulk, one-off or recurring, domestic or cross-border comes already close to reality.

With digitalization also cybercrime figures are soaring in UK!

But this “vibrant retail market” comes at a high cost for British consumers as UK also became the epicenter of online fraud during the past years.

According to a recent study done by the UK Parliament, online fraud is the most commonly experienced crime in England and Wales today. It accounts for approximately 41% of all crimes against individuals. A person aged 16 or over is more likely to become a victim of fraud than any other individual type of crime, including violence or burglary. It costs the UK economy billions every year. According to the study, long-term drivers for this development are London´s place as a global financial center, the international prevalence of the English language and its rapid digitalization and globalization.

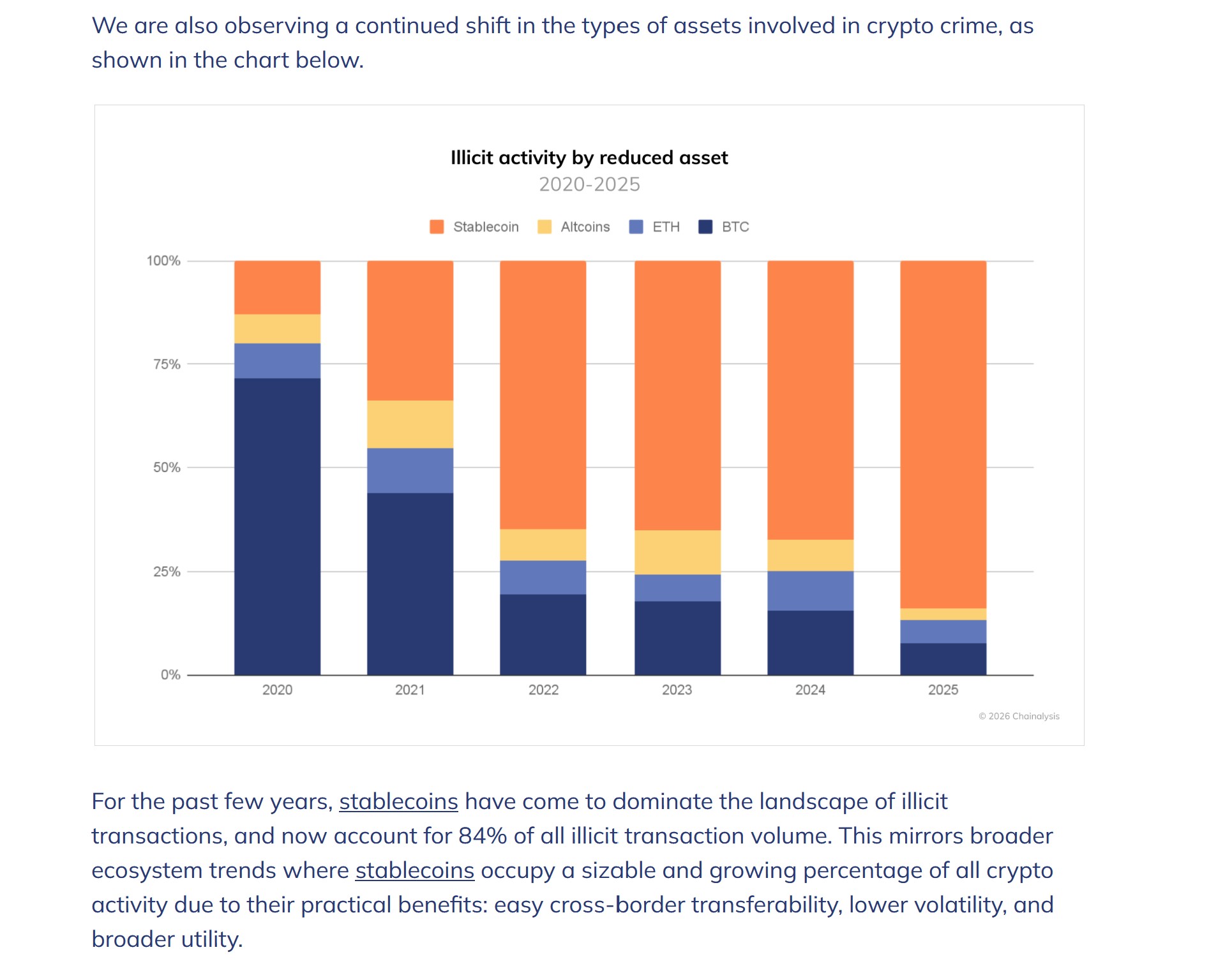

Short-term drivers include the COVID-19 pandemic, the recent cost of living crisis, and the emergence of crypto assets.

The result has been a drastic increase in digital fraud. 80% of reported frauds are cyber-enabled; they could have taken place offline, but their scale, reach and impact have been expanded by the use of online services and digital technology.

Above all, the UK experienced a massive increase in authorized push payment (APP) fraud, when a person or business is tricked into sending money to a fraudster posing as a genuine payee in the past years.

UK Finance data showed that authorized app fraud increased drastically in 2021 to a record GBP 355,5m. But this is only a fraction of the loss as most victims do not file a complaint.

Understaffed law enforcement agencies and the relaxed approach of the UK authorities and regulators in respect of the Fintech sector fires back.

The payment sector and its evident compliance issues.

The report issued by Transparency International UK in May 2022 called” Together in electric Schemes” Analyzing money laundering risk in e-payments” found that FCA registered e-money institutions are routinely exposed to illicit funds.

Almost one-third (19,293) of the total suspicious activity reports relating to suspected criminal funds filed in 2021 came from the electronic payment sector, of which EMIs make up a significant proportion.

There are extensive regulations in place stipulating how EMIs must operate, which are overseen by the FCA.

These require payment companies to have fit and proper persons in management positions and that they have measures in place to detect and prevent money laundering as the qualify as “obliged parties” according the AML regulation.

Transparency UK identified 29 (11 percent) PIEMIs authorized by the FCA named in adverse media as having ineffective anti-money laundering (AML) controls or processing criminal wealth. Furthermore, a quick Open Source analysis revealed several owners, directors, and senior management of registered payment companies being named in ongoing money laundering investigations or accused of moving dirty money. A good example is Safened Ltd., an FCA-registered payment institution run by the former management of Payvision. Payvision is currently under criminal investigation by the Dutch FIOD.

List of payment companies showing up regularly in online fraud

Transparency UK did not name the identified PIEMIS in its report but we guess some of them to correlate we those we identified in the course of our work.

Complaints regarding the EMIs soar as business grows!

As reported recently by FT the sharp rise of online payments firms and digital-only banks has been accompanied by growing consumer complaints in the UK and EU. The problems, disgruntled clients say, are exacerbated by patchy customer services and incomplete consumer protections covering companies licensed as so-called e-money providers, as opposed to banks.

Complaints about e-money issues are mounting. The UK Financial Services Ombudsman handled nearly 10,000 such claims in the past two years, nearly four times as many as in 2019 and 2020 combined. These include complaints against traditional banks, digital banks and others offering e-money services, as well as specialist e-money firms. The ombudsman has generally upheld a higher proportion of e-money complaints than its average rate in recent years, suggesting there are more legitimate gripes than with other products.

FCA PRIORITIES FOR PAYMENTS FIRMS!

With the fraud issue becoming a high-priority topic in the UK and the payment companies being only slow in adjusting to the new “Customer Duty” rule, the FCA has become increasingly concerned, warning last month that it would close payment companies unless they addressed issues generating an “unacceptable risk of harm” to customers.

As of 16 March 2023, the FCA sets out in its letter to the PIEMIs major priorities to address areas of concern, with actions for all firms to take as levels of scrutiny continue to intensify and the deadline for application of the new Customer duty regulation (end of June 2023) is approaching.

The areas of focus identified in the letter are wide-ranging, making it essential reading for all those in the sector.

The FCA wants firms to take appropriate actions to achieve three key outcomes:

A. safeguarding costumer funds

The FCA’s concern that the disorderly failure of a firm puts customers’ money at risk. The regulator has reiterated both safeguarding and wind-down planning, as well prudential risk management as priorities for ensuring customers’ money is sufficiently protected.

All payments and e-money firms are expected by the FCA to always maintain financial resilience. So the PIEMIS are expected to manage their liquidity risk, and have robust and realistic plans for enacting an orderly wind-down.

B. Securing the integrity of the financial system

The second outcome focuses on addressing the risk that financial crime poses to the integrity of the financial system.

Firms are required to embed appropriate AML/CTF frameworks, incorporating ongoing KYC and customer due diligence controls throughout the customer life cycle. According to the letter, regular reviews of these frameworks and risk appetite statements must also be undertaken, and addressing any weaknesses identified to ensure that your AML and fraud prevention measures are effective and commensurate the risks facing your business.

C.Meeting customer needs

The third of the FCA’s outcomes requires PIEMIs to provide high-quality products and services that meet your customers’ needs. The regulator is concerned that some products and services don’t deliver good customer results and that some firms may not always act in the best interests of their customers.

Can improvement be expected?

We wrote several letters to FCA during the past years about regulated payment institutions showing up on victims´vouchers like Moorwand Ltd. without any result. So any movement from the FCA is welcome, but most probably, writing letters and talking about improved “Customer Duty” – a rather vague term – will not be enough to reestablish trust in the UK payment industry.

Comments are closed.