EFRI Founder Elfriede Sixt Interviewed by FinTelegram (Part I):

The European Funds Recovery Initiative (EFRI) was founded in 2018 by CPA Elfriede Sixt, together with FinTelegram and a team of lawyers. Since then, EFRI has represented more than 1,000 scam victims, with total damages of approximately €60 million.

In addition to supporting victims, EFRI has filed criminal complaints against scammers and their financial enablers. Today, EFRI is likely the most hated institution within the global scam and cybercrime community.

In this interview, Elfriede Sixt shares her experiences in the ongoing fight against cybercrime

Q 1: Please introduce yourself!

I have worked as an auditor and tax accountant for over 30 years. I began my career at EY in Vienna and New York, where I quickly became one of the youngest partners in the Vienna office. At EY, I was responsible for IFRS and corporate finance.

After 14 years, I left EY Vienna to establish my own practice, focusing on advising startups in the digital industry. In 2014, I published a book on crowdfunding, followed by a book on blockchain and Bitcoin in 2016 (see here).

Q 2: Please tell more about your approach.

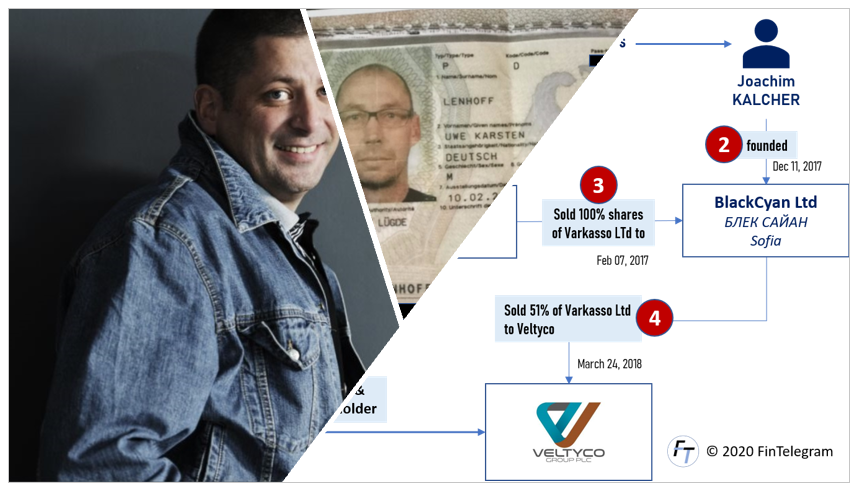

In March 2017, I filed a money-laundering complaint against the German online entrepreneur Uwe Lenhoff, one of the beneficial owners behind the binary options schemes Option888, XMarkets, TradoVest, and other scams. Together with BitRush Corp’s then-technical director Joachim Kalcher and Slovak entrepreneur Igor Wollner, Lenhoff intended to use the Canadian company BitRush Corp—then a publicly listed pioneer in crypto payments—for money laundering. Around the same time, Austrian law enforcement began investigating Lenhoff and his cybercrime organization.

As a result of my complaint, cooperation with Austrian authorities intensified, leading to the arrest of Uwe Lenhoff and Gal Barak and the dismantling of the E&G Bulgaria cybercrime organization in January 2019. Consequently, FinTelegram founder Werner Boehm and I were listed as witnesses in these criminal proceedings. In the process, we inadvertently uncovered an international cybercrime network on the dark web, involving Lenhoff, Barak, Gery Shalon, Vladislav Smirnov, and others.

When I decided to make the fight against cybercrime my mission, we founded EFRI in early 2018 with the support of FinTelegram and a group of lawyers. My aim was to help victims and make the internet a safer place—perhaps a naive approach, but a necessary one.

In the criminal proceedings against Gal Barak and his wife Marina Barak, EFRI’s lawyer represents most Austrian victims. In the cases of Lenhoff and Barak, EFRI’s lawyer also filed criminal charges against Rudolf Booker, the founder and former CEO of Payvision, one of the main payment service providers enabling scam networks across several countries. EFRI has also drawn media attention to Payvision’s activities. In Austria, an EFRI-coordinated lawyer filed the first civil lawsuit against Payvision, while lawyers in Switzerland and Germany are already pursuing additional cases.

Just a few weeks ago, Payvision’s parent company ING announced the closure of Payvision—a development I consider very positive.

Still, the fight against the E&G cybercrime organization is only one part of our daily work. Today, we represent victims of many other large scams. In these cases as well, we take action against both the scammers and the banks involved by filing criminal complaints across Europe.

As a result, EFRI, FinTelegram, Werner Boehm, and I have likely become the worst enemies of scammers and their enablers.

Q 3: How are you doing in this fight against the scammers?

First of all, this is a very lonely and demanding fight. Apart from the victims themselves and the police officers who do the groundwork—meeting the victims, seeing their distress and the damage caused—our efforts are rarely appreciated.

By now, the financial market supervisory authorities in Germany and many other countries know us very well. I can almost picture them groaning when they see my email or phone number appear in their inbox or on their phones—because whenever we reach out, it is never with good news for them.

Law enforcement agencies do not always welcome us with open arms either. Restitution—actually trying to get money back for victims—is not a top priority for them. On top of that, I constantly push for information they are reluctant to share.

And in Austria, even the national bar association has questioned our work, accusing us of “stealing lawyers’ business” simply because we organized a non-profit victims’ association.

Q 4: How does the hate of the scammers manifest itself?

In 2018 and early 2019, FinTelegram founder Werner Boehm and I received death threats and even kill orders from Uwe Lenhoff. We were stalked and blackmailed with secretly taken photos of my children and me while shopping, and I was pressured to remove critical reports from FinTelegram. Nevertheless, in early 2019, EU law enforcement agents arrested Uwe Lenhoff and Gal Barak—a real success.

Today, after the – hopefully only temporary – release of Gal Barak and Marina Barak, they have shifted to smear campaigns: dedicated websites, fake Facebook and Instagram ads, and more.

Defamatory cartoons of me circulate online. Fake news articles claim that I am facing criminal proceedings and that I have already been convicted several times. These are outright slanders, designed to destroy my reputation and silence me in the fight against cybercriminals like Gal and Marina Barak, and their facilitators such as Rudolf Booker and Payvision.

Q 5: What is this BitRush story about?

I served as the accountant for the publicly listed Canadian company BitRush Corp, co-founded by Werner Boehm and his partners. In this role, during the summer and fall of 2016, I refused to hand over the IFRS accounting documents for the group after discovering that the company’s Chief Technical Officer, Joachim Kalcher (pictured left), intended to use BitRush’s crypto technology for money-laundering purposes. Around that time, Boehm asked me to conduct due diligence on Uwe Lenhoff and his company Veltyco, after BitRush Corp announced plans to partner with Veltyco (now Bet90 Holdings PLC), Lenhoff’s publicly listed vehicle in London.

My due diligence revealed that Lenhoff was deeply involved in illegal activities and money laundering. I reported these findings to Boehm and the BitRush Corp board, and I also filed a money-laundering complaint against Lenhoff and his associates, whom I regarded as a cybercrime organization. Boehm himself filed a criminal complaint against Lenhoff in the UK in September 2016.

Surprisingly, Slovakian investor Igor Wollner told me that refusing to do business with Lenhoff would be a “missed opportunity.” This triggered a conflict between the BitRush founders and Wollner. Wollner pushed BitRush Corp to file lawsuits in Canada aimed at seizing Boehm’s shares in the company. The BitRush board also pressured me to hand over the accounting records, but I refused.

To justify their actions, they fabricated the absurd claim that Boehm had withdrawn more than CAD 500,000 from BitRush accounts in 2015 and 2016 and transferred it to a private company allegedly owned by him. In reality, Boehm was never a board member or director and therefore could not authorize bank transfers without board approval. Moreover, in April 2016, a Canadian auditor issued an unqualified audit opinion covering all transactions for 2015 and Q1 2016. The audit found no irregularities whatsoever. The lawsuit was a complete sham.

Still, Wollner, a politically exposed person in Slovakia, was determined to work with Lenhoff. When Boehm—on my advice—refused, Wollner invested heavily in expensive Canadian lawyers to force Boehm and his partners out of BitRush. Neither Boehm nor I accepted Canada as the proper venue (forum non conveniens), and we chose not to contest the allegations in court. In my view, you cannot fight cybercriminals in a civil courtroom. As a result, the Canadian court had no choice but to accept Wollner’s claims.

Later, however, criminal investigations in Europe and subsequent arrests confirmed the accuracy of my due diligence.