Amid the COVID-19 pandemic, hundreds of millions of people are locked down in their homes or must apply social distancing rules. Hence, their social activities are limited to social media and messenger services. The perfect environment for financial fraud is right now reaching new dimensions.

Acting cross-border is an essential part of the script for any scam, even though it remains a significant obstacle for law enforcement worldwide.

During the past months, based on documents provided by victims, we realised that scammers are increasingly involving operations in Asia to rip off Europeans

Recently, 29 new European members have joined EFRI; all victims were targeted by highly sophisticated investment fraud schemes based in the international financial centre of Hong Kong. The scammers realised that Hong Kong is an ideal location for their activities.

Hong Kong – a fraud epicentre

Lured by fancy brokerage websites[2] and allegedly highly experienced brokers presenting compelling investment opportunities, unsuspecting European retail investors deposit material amounts with Hong Kong-based trading Companies for investments in promising Asian Technology Companies.

The role of Hong Kong Company builders in this kind of investment fraud

According to our investigations, Hong Kong company builders

- administer the fake promising Chinese “Technology Companies” (the investment opportunities) as well as

- set up and administer the fake “Trading Companies” supposed to handle the acquisition of the shares in the fake Hong Kong investment opportunities.

Non-active shell companies are marketed as promising Chinese Technology Companies (investment opportunities)

Shell companies, registered years ago, are rebranded as promising “Technology Companies” with upcoming IPOs or shares of these companies being put up for sale. Sophisticated websites and fake reviews in reputable online media pretend a successful Technology Company operational in Hong Kong.

All Trading Companies that used to receive funds for investment from European retail investors exhibit the following characteristics.

- The majority of these Trading Companies are newly founded, with the registration process done by only a limited number of Hong Kong Company builders[3].

- More or less, all of them have their registered offices in the relevant Hong Kong Company builder’s offices.

- The registered managing directors and nominee shareholders are Mainland Chinese with no residency in Hong Kong.

- All these Trading Companies have no employees.

- The business purpose as registered in the commercial register of Hong Kong does not match with the apparent activities of these Trading Companies – exclusively acting as illegal payment service providers.

Most of the 55 Trading Companies used for luring investments were dissolved. Later on, all bank accounts got emptied. The scammers sent the victims’ money to offshore accounts.

Hong Kong’s status as an international financial centre, the relative ease of company formation, and its geographic location expose it to misuse through scammers.

Examples are as follows:

| Company Name | Hong Kong CR# | Date of registration | Website |

| Data Control Technitic | 1145518 | 29th June 2007 | https://www.datacontroltechnitic.com |

| 3D Printer Technology | 1910328 | 21st May 2013 | https://www.3dprintertec.com |

| LECTRIFI Limited | 2490183 | 28th February 2017 | http://www.lectrifi.com |

| DigitalPay Limited | 2121502 | 17th July 2014 | https://www.idigipay.com |

| Green Farm Asia | 2105729 | 6th June 2014 | https://www.greentechfarm.com |

The role of the Hong Kong bankers´in the scams is a shame.

Hong Kong is an active member of international AML/CFT organisations. Hong Kong has been a member of the Financial Action Task Force (“FATF“) since 1991 and a founding member of the Asia/Pacific Group on Money Laundering (“APG”) since 1997.

Hong Kong is one of the largest international financial centres worldwide, with a highly externally oriented economy and relative ease of company formation. Hong Kong’s authorities and banks are aware that the City is attractive to criminals seeking to hide or launder funds.

More astonishing, the fact that since July 2017, a considerable number of European fraud victims have been told to make deposits to Hong Kong shell companies (presented as legitimate Trading Companies) – with bank accounts held with some of the most prominent and most respected financial institutions worldwide.

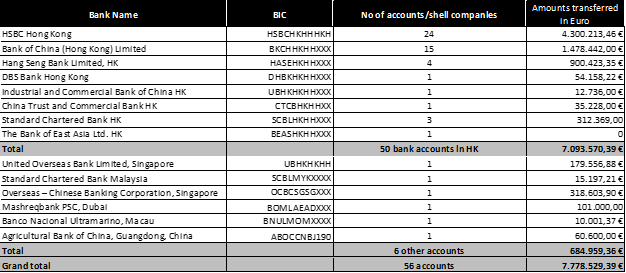

In total, 29 victims – registered with EFRI – transferred close to €8 million to 55 Hong Kong-registered Trading Companies with 50 different Hong Kong bank accounts and six bank accounts in other jurisdictions:

Hong Kong banks do not adequately apply Know Your Customer (KYC) due diligence procedures and fail to monitor ongoing transactions for suspicious activity as required by the FATF’s KYC/CFT standards.

Alarming hints that the bankers even actively supported the scammers are as follows:

Serial opening up of bank accounts for shell companies organised by Hong Kong Company Builders.

Material wire transfer amounts (some > €200k) from European retail investors have not raised red flags within the banks.

Some transfers made by the victims had insufficient bank account numbers; however, the receiving bank personnel did the transactions without any inquiries.

The total size of the scams in Hong Kong

The experience of fraud has a tremendous social impact on European investors who have been defrauded. They have sent their hard-earned funds to one of the supposedly best-regulated and supervised financial markets worldwide.

New victims of these Asian investment fraud schemes are emerging daily, increasing the total number of losses. The actual number of victims must be tremendous, and the amounts transferred most likely reach hundreds of millions.. Fact-based estimates indicate that hundreds, if not thousands, of victims in Europe are impacted.

The victims take action.

The victims have alerted the Hong Kong supervisory authorities and the compliance departments of the banks involved. Criminal complaints have been filed against the scammers and the banks involved in the home jurisdictions of the European victims and Hong Kong.

Still, it remains to be seen whether the ongoing investigations will yield any outcome, which would provide support and hope for many victims here in Europe; in particular, it will be interesting to see whether the banks acknowledge their specific responsibility.

In case you are also a victim of this kind of fraud, please get in contact with us ([email protected]) or with the group of victims (Action against Investment Scam Asia) mentioned [email protected].

———————————–

[1] The group calls its “Action against Investment Scam Asia”. It is an ever-growing group of aggrieved investors from all over Europe. The group has launched its website (https://www.investment-scam-asia.com/en/) to alert the public to this scamww.cwholtadvisory.com and https://www.rjcmitchellconsultants.com

[3] The role of the “company builders in Hong Kong.”

Only a limited number of Hong Kong company builders were identified, who registered the majority of shell companies. These company builders also serve as company secretaries for these shell companies and provide the official address in Hong Kong for these entities. Two names of these company builders stand out: BSIDA International Business (HK) Limited and Hong Kong Ten Yan Business Secretary Limited, which were only registered on 12th January 2018.