We have formally filed a Woo (Open Government) request with De Nederlandsche Bank (DNB) to disclose the 2020 on-site inspection report on Payvision B.V.—plus its attachments, the 2019/2020 Kroll compliance review, and the criminal complaint DNB filed regarding Payvision. Victims have waited long enough. Redact what you must; disclose what you can. DNB was the supervisory authority in charge of Payvision B.V. from 2012 up to July 2023 (when Payvision B.V. returned its payment institution license).

What we filed—exactly

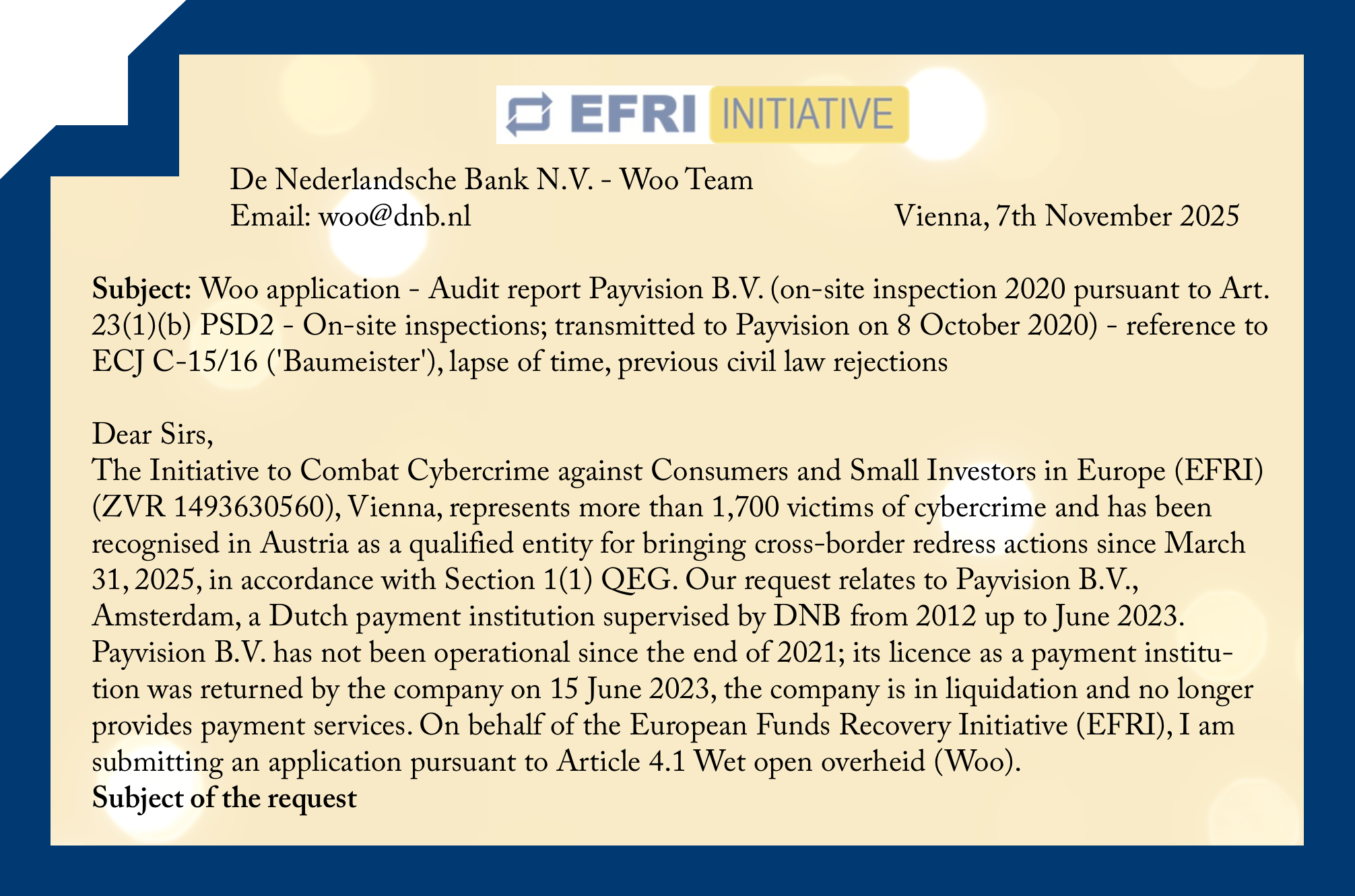

On 7 November 2025, EFRI submitted a Woo application requesting:

DNB’s 2020 on-site inspection report on Payvision B.V. under Art. 23(1)(b) PSD2, including all attachments (cover/management letter, table of contents, interim decisions, follow-ups) with versions and dates.

The Kroll report (2019/2020) on Payvision’s compliance systems as made available to DNB.

DNB’s criminal complaint concerning Payvision B.V. and/or its directors.

We also asked for a document-by-document index (title, date, pages, version, dispatch/recipient) and, where DNB relies on an exception, a specific Woo legal ground per passage with a short harm test.

Partial access is the rule, not the exception

We explicitly request partial access: names and genuine trade secrets can be redacted; internal opinions can be anonymised; and summaries/aggregated versions should be provided if full text cannot be released yet. The ECJ’s Baumeister (C-15/16) ruling is clear: there is no blanket secrecy over supervisory files—authorities must assess passage by passage. With the passage of time, most business-confidential material loses sensitivity unless a concrete, continuing need is shown.

Why now

Payvision has been non-operational since late 2021; its licence was returned in 2023; the company is just an empty shell (with some pending legal claims) The old secrecy reflex no longer applies.

Victim interest is overwhelming. EFRI represents hundreds of victims harmed through Payvision’s acquiring rails. The victims still suffer from financial and mental distress. 700+ supporters have already backed our public petition demanding transparency.

We are preparing collective redress in the Netherlands. Truth is a prerequisite for justice. The public deserves to know what DNB found, when it knew, and what was done.

What DNB must do next

Acknowledge receipt and issue a decision within four weeks (extendable once by two weeks for complex cases).

Conduct a document-by-document review and release everything that can lawfully be disclosed, applying targeted redactions where strictly necessary.

Explain each refusal precisely—generic references to regulatory secrecy will not do.

We have asked for searchable PDFs via email or download link. If DNB refuses disclosure, it must state specific, current supervisory reasons why transparency would still cause concrete harm today.

What’s at stake

It is about accountability for systematic money laundering failures and that enabled cross-border investment fraud to ravage European consumers. The victims live with the financial and psychological damage every day. Institutions must stop hiding and supporting financial crime enablers in covering up. Open the file. Let the facts speak.

Justice for the victims

Our civil action against DNB in 2023 (a request according to civil law rules) in the Netherlands was dismissed, on the basis of regulatory-secrecy arguments. In that proceeding, DNB was represented by Pels Rijcken. This is not an endpoint for EFRI: we will continue to pursue transparency and accountability by all lawful means—from Woo disclosures to further civil and collective redress—until the relevant facts are on the record and justice is achieved for the victims

The Payvision B.V. affair is a stain on Dutch supervision; as Wirecard was for Germany, so Payvision is for the Netherlands. We expect DNB’s new leadership to finally act decisively and deliver justice.