Scam advertising on Meta’s platforms is no longer “just” a consumer harm story; it is increasingly a litigation story in the United States. In late 2025, Reuters published a series of investigations describing how Meta internally tracked “high-risk” scam ads, assessed legal exposure, and debated advertiser verification approaches under regulatory pressure.

At EFRI, this trend is not abstract: more than 70% of our members have been lured by ad scams, mainly on Facebook, into scams they ultimately fell victim to.

Below is an overview of the most important scam-ad cases currently moving through US courts, why they matter legally, and what to watch next.

Why these US cases matter: Section 230 vs. “platform conduct”

Most US civil claims against platforms for harmful third‑party content collide with Section 230 of the Communications Decency Act which often shields platforms from being treated as the “publisher” of someone else’s content.

What’s changing is how plaintiffs frame the liability theory. Across today’s Meta scam-ad lawsuits, plaintiffs increasingly argue:

Meta is not merely “hosting” ads, but actively operating an ad-tech system that targets, optimizes, and amplifies fraud funnels; and/or

Meta has contractually promised to take action against scams in its Terms/Standards—and should be held to those promises (a theory that has gained traction in Ninth Circuit case law).

Forrest v. Meta (Australian billionaire; US federal court)

Case: Andrew Forrest v. Meta Platforms, Inc. (N.D. California, Case No. 22‑cv‑03699)

Core allegation: Scam ads allegedly used Andrew Forrest’s identity to promote fraudulent schemes, raising the question of whether Meta can be sued when its systems distribute and profit from that advertising.

A US judge allowed the case to proceed past early dismissal arguments tied to Section 230—meaning Meta did not win a clean immunity exit at the pleading stage.

The case is now deep enough that the court is managing phased discovery focused on Section 230 immunity, i.e., discovery “directed to facts bearing on Meta’s section 230 immunity defense.”

This case is a live test of whether a court will treat Meta’s ad delivery and enforcement choices as sufficiently “platform-driven conduct” to avoid the usual immunity outcome.

Calise v. Meta (contract pathway survives; negligence fails)

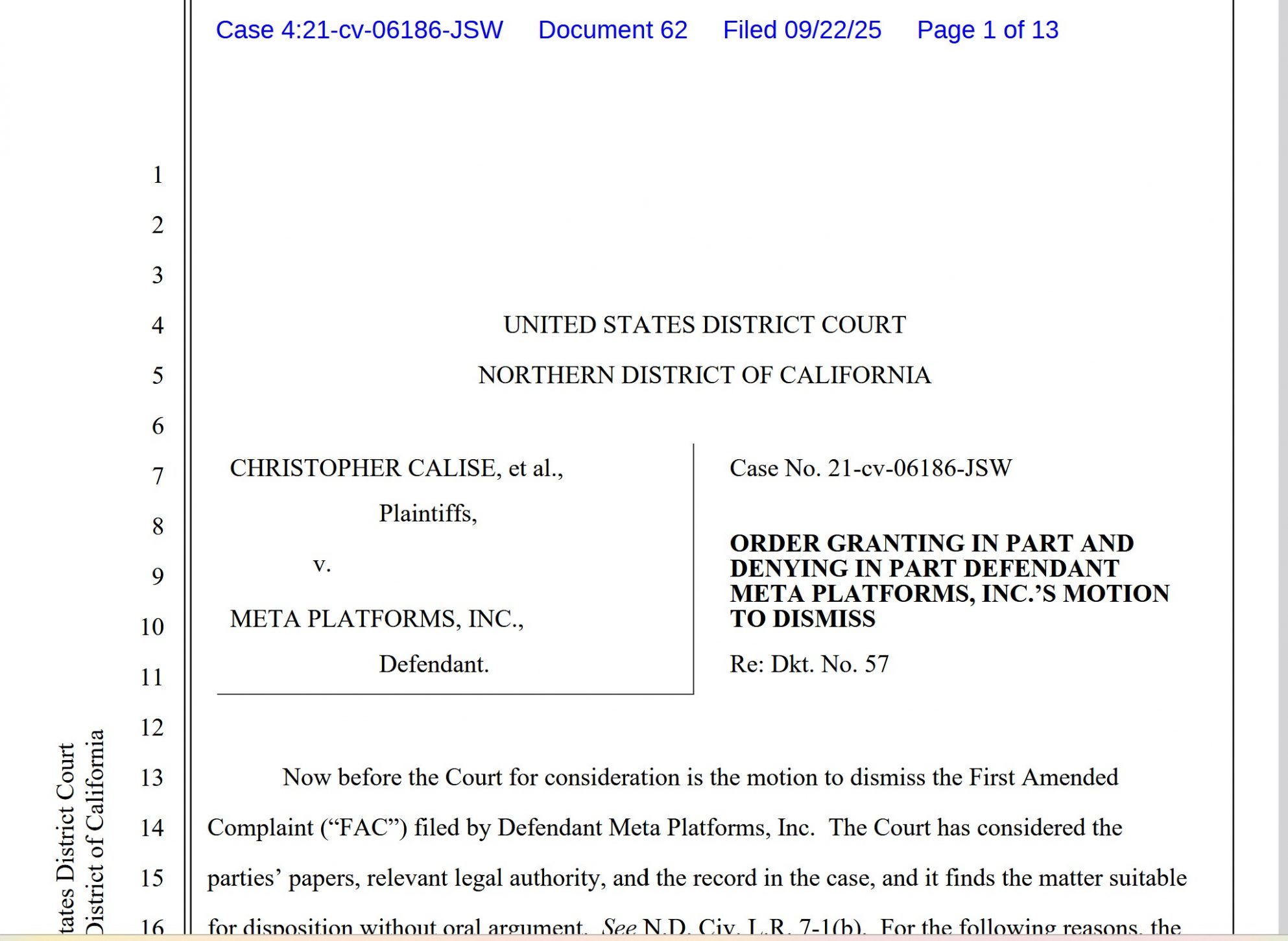

Case: Calise v. Meta Platforms, Inc. (Ninth Circuit + N.D. California on remand)

Core allegation: Scam Victims’ claim they were harmed by fraudulent third‑party ads on Facebook and that Meta violated its own terms/policies related to scam advertising.

In June 2024, the Ninth Circuit held that Section 230 barred the plaintiffs’ non‑contract claims (like negligence/UCL/unjust enrichment), but did not bar the contract-based claims, because a duty arising from Meta’s promise to take action against scams can be treated as separate from “publisher” status.

On September 22, 2025 order on remand, the district court:

kept the breach of contract claim and breach of covenant of good faith and fair dealing claim; and

dismissed a negligent failure-to-warn theory (notably relying on California’s economic loss rule for purely financial harm).

Why it matters

This is currently one of the most important “legal architecture” cases in the US for scam ads:

If courts treat platform anti-scam commitments as enforceable promises, platforms face contract exposure even where tort theories fail.

That, in turn, may influence how platforms draft terms/policies—and how victims plead claims.

Bouck v. Meta (victims allege aiding-and-abetting + contract + Unruh Act)

Bouck v. Meta (victims allege aiding-and-abetting + contract + Unruh Act)

Core allegation: Plaintiffs say they were targeted via Facebook/Instagram ads promoting “investment clubs” tied to celebrities/advisers, then funnelled into WhatsApp groups where scammers pushed a manipulation scheme involving a thinly traded stock (CLEU).

The claims (what plaintiffs are trying to prove)

The complaint includes, among others:

Aiding and abetting fraud (arguing Meta substantially assisted the scheme through ad tools/targeting);

Breach of contract (arguing Meta’s Terms/Standards promise it does “not allow” investment scam ads, and that Meta failed to uphold that);

Unruh Civil Rights Act theory tied to alleged race/ethnicity-based targeting, and

Unjust enrichment (seeking disgorgement of ad revenues tied to the scam).

The docket shows the case is active and has progressed into motion practice, including a motion to dismiss and related briefing.

The court calendar lists a motion-to-dismiss hearing on January 13, 2026.

(Separately, a docket entry reflected an earlier hearing date in early January 2026, indicating schedule movement is possible.)

Bouck is notable because it pushes beyond “you hosted scam ads. Questions addressed are how ads were targeted/optimised, and whether Meta’s monetisation + alleged knowledge can support secondary-liability style claims.

Suddeth v. Meta (impersonation ads + false endorsement + right of publicity)

Case: Suddeth and Perkins v. Meta Platforms, Inc., et al. (N.D. California; filed Oct. 7, 2025)

Core allegation: The complaint alleges Meta unlawfully used financial professionals’ identities in paid ads and related promotional content across Facebook/Instagram/WhatsApp, steering users into WhatsApp “investment groups” linked to “Chinese Stock Scams.”

This suit is explicitly framed around:

Lanham Act §43(a) (false endorsement/association),

California right of publicity (statutory and common law),

California UCL,

Florida right of publicity, and

Florida UDAP-style law (FDUTPA)—plus analogous state laws.

The complaint also references a June 11, 2025 warning by a bipartisan coalition of state Attorneys General urging Meta to act against investment scam ads, alleging that materially similar funnels continued afterward.

Public docket summaries reflect an initial case management process set into January 2026.

Bouck and Suddeth have also been treated as related in the N.D. California docketing context, underscoring that courts are seeing these cases as variations of a common pattern: paid impersonation ads → WhatsApp funnel → financial harm.

Suddeth is strategically important because it relies less on “victim loss” alone and more on identity misuse, deception, and false endorsement, and it targets the cross-product funnel (Facebook/Instagram ads + WhatsApp groups) as an integrated “system,” not siloed apps.