For victims of online investment fraud, the suffering does not end when the fake trading platform disappears. It often begins again — under a new name, with a new promise, and the same underlying lie:

This sentence has deceived thousands of victims across Europe. It is the foundation of a multi-million euro industry built on false hope — the so-called recovery scams. These schemes target those who have already lost everything and exploit the one thing left to manipulate: the desperate belief that the stolen funds are still available and are refundable.

How the illusion begins

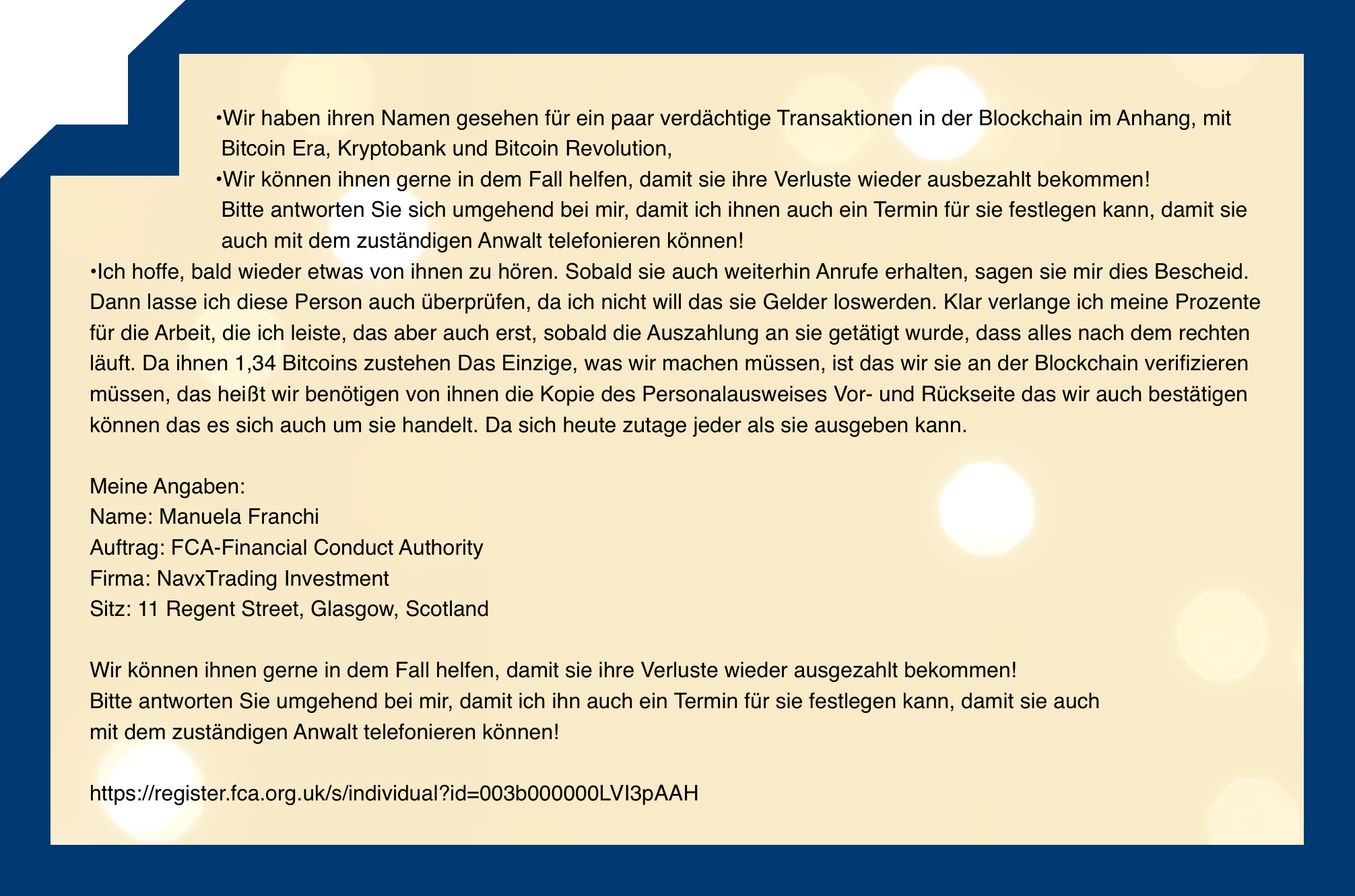

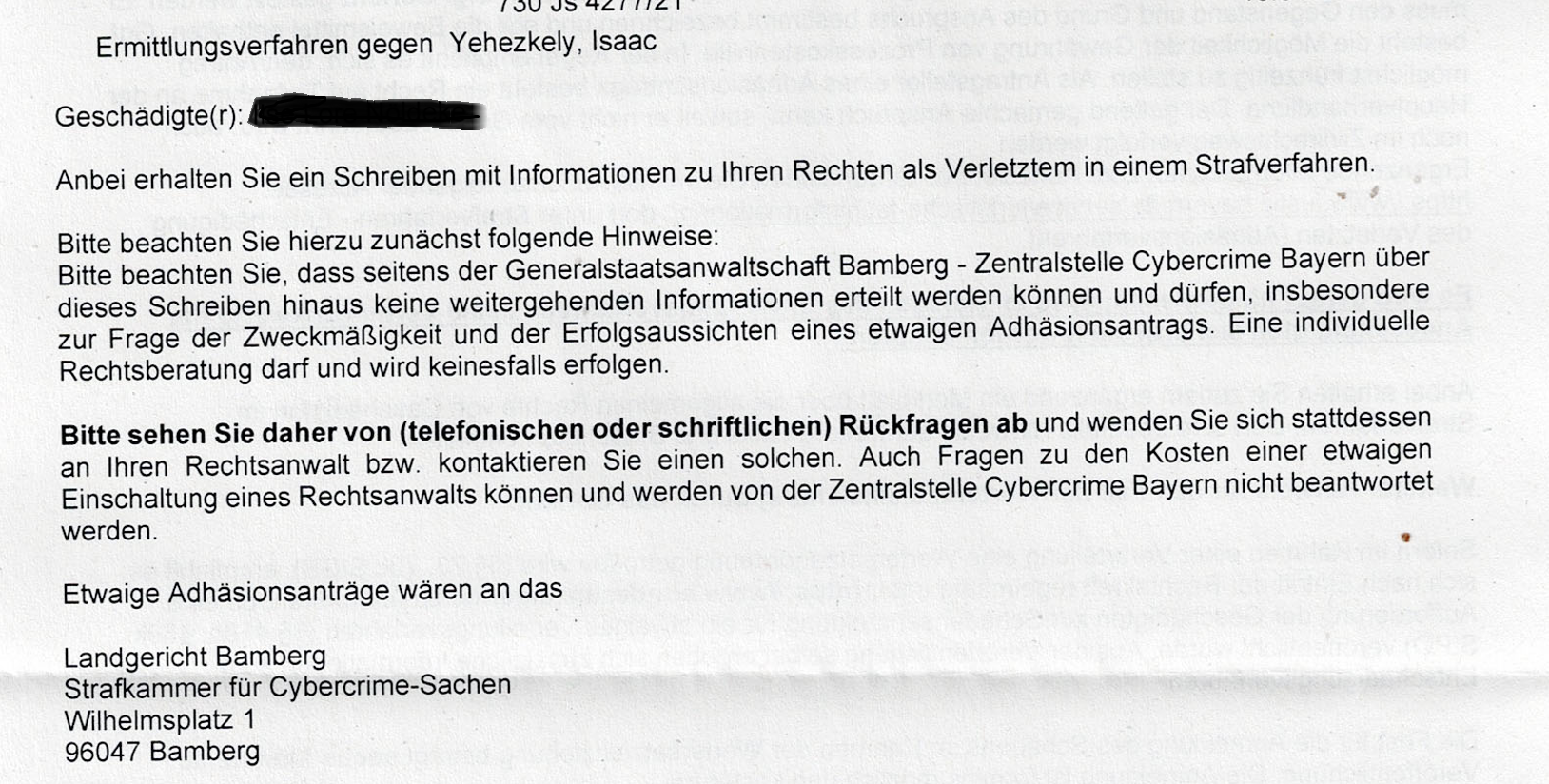

The recovery fraudster usually contacts the victim out of nowhere — via e-mail, phone, or even WhatsApp. They present themselves as investigators, lawyers, blockchain experts, or representatives of financial authorities. Some claim to act on behalf of Europol, Interpol, the FCA, or BaFin. The documents look convincing: official seals, legal language, signatures, and a reference number that appears authentic

Then comes the promise: the money was never really gone. It was merely “frozen” by a payment processor, “under investigation by the authorities,” or “awaiting release” from a blocked account. In reality, this story is pure fiction — carefully crafted to rebuild the victim’s trust.

The scammer’s psychological weapon is the same one that drove the first fraud: credibility through detail. They often know exactly when and how the victim paid into the original scam, because the data has been stolen or sold from the fraud networks themselves. The victim thinks, “They know everything — they must be legitimate.” From that moment, the trap is set

The second fraud

Once the victim believes that the money still exists, the recovery scammer introduces a supposed obstacle: a fee, a tax, a compliance verification, or a small transfer “to activate the refund.” The sums appear minor at first — €150, €300, €500 — but each payment opens the door for the next excuse.

Victims are told that “the funds have been approved for release” but another payment is required for “final clearance.” Others are told that the money is “held by a central bank” and can only be released after a “legalization fee.” Every step is designed to create the illusion of progress while extracting more and more money.

What makes these scams especially cruel is their use of official language and emotional manipulation. Many victims receive fake court letters or forged bank documents stamped with the logos of well-known institutions. They are told their refund will expire unless they act immediately — a classic tactic to override rational judgment through fear and urgency.

Why these recoveries never happen

EFRI has investigated hundreds of such cases. Not one single victim has ever received a legitimate refund through these so-called “recovery companies.” None of these services work with real law firms or authorities. The truth is harsh but simple: the money stolen in investment frauds is almost never sitting somewhere waiting to be released.

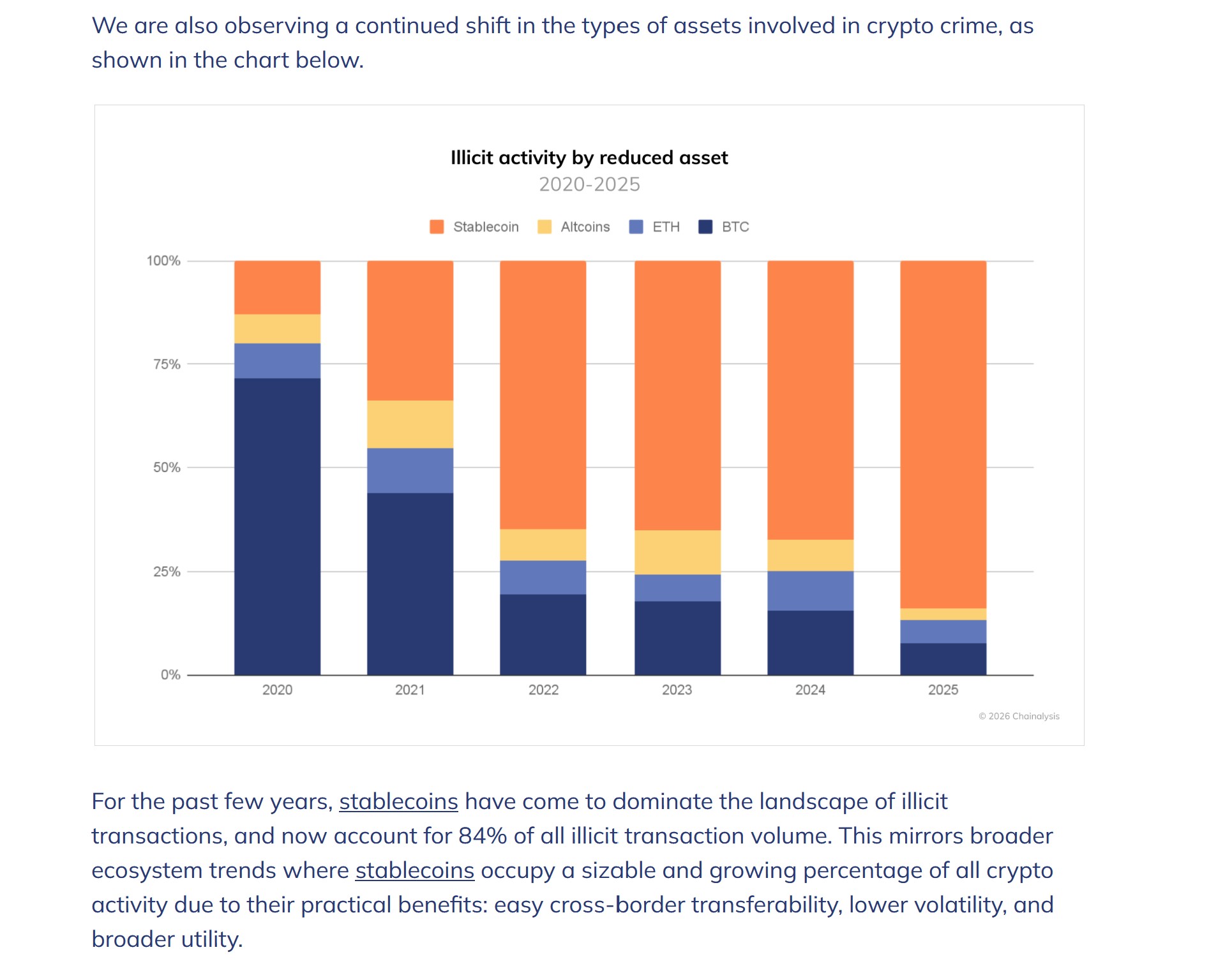

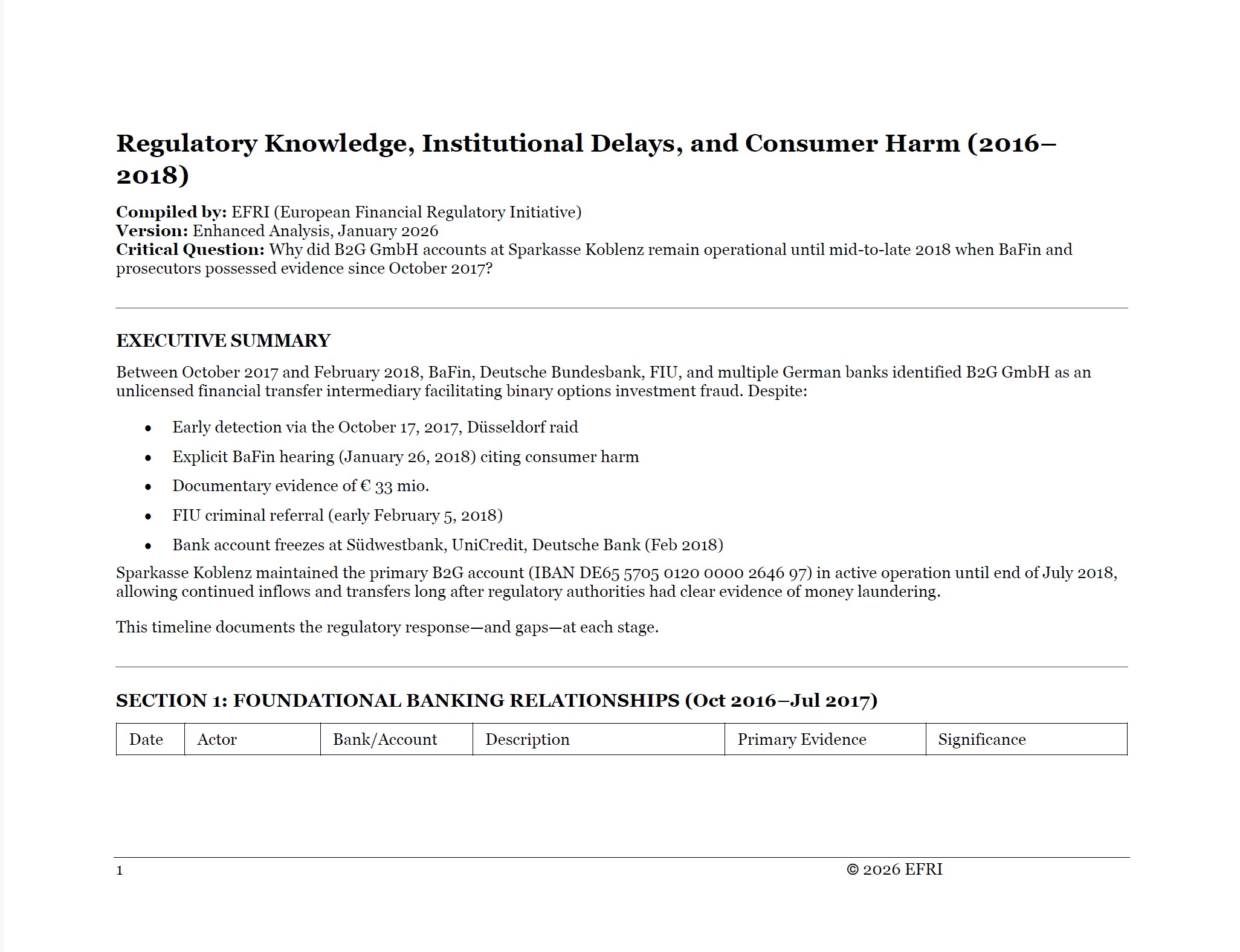

In most cases, the funds have long been laundered through complex networks of shell companies and crypto wallets. There is nothing left to “unlock” or “recover” with a phone call or a payment. Every claim that “the money is frozen” is a calculated lie.

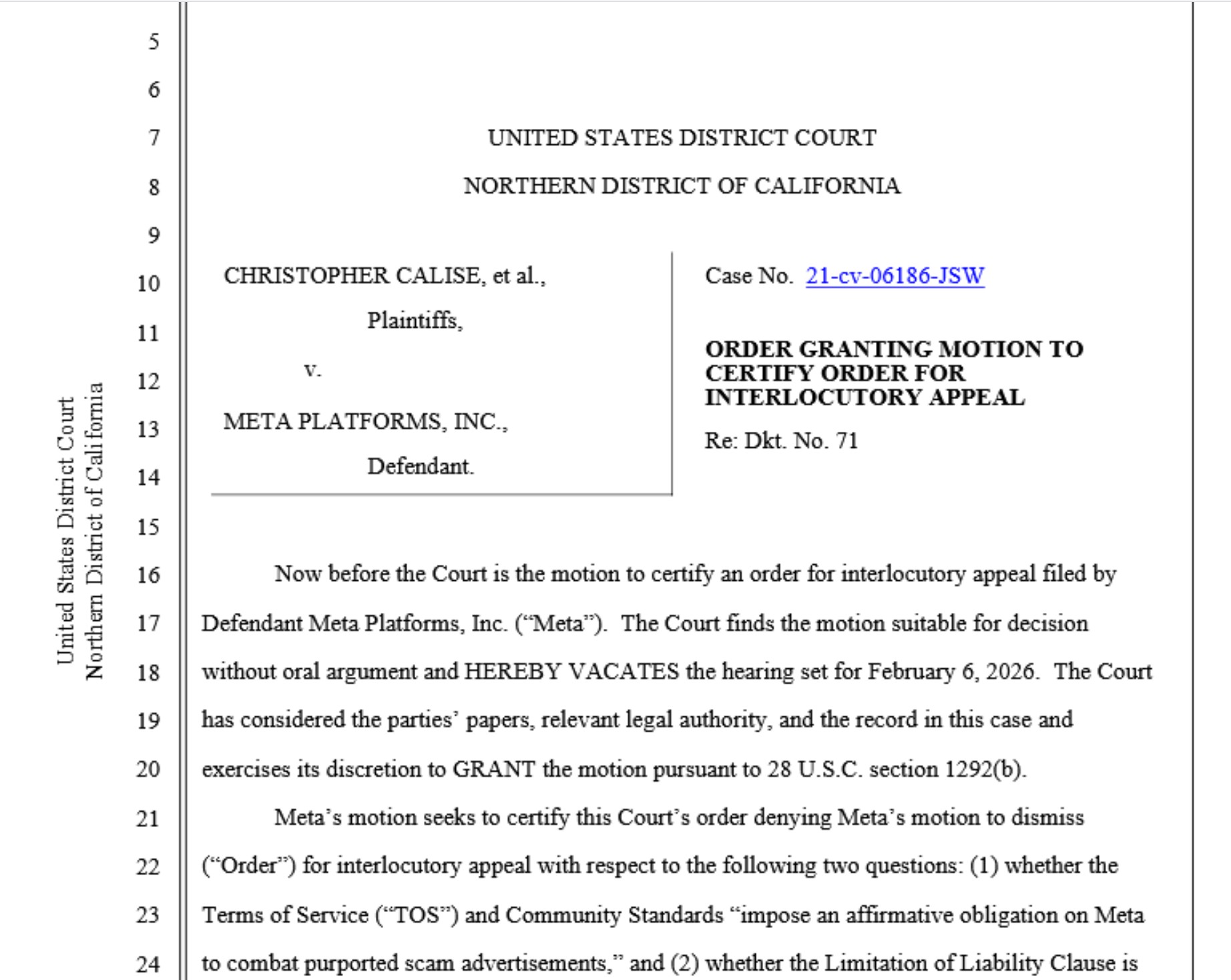

Real recovery is only possible through the legal system — by holding the banks, payment institutions, and financial intermediaries accountable for their role in processing fraudulent transactions. That requires lawyers, evidence, and collective legal action — not Telegram chats and Gmail accounts

The pattern of re-victimization

Recovery scammers exploit the same psychological vulnerability as the original fraudsters: hope. After months of silence from authorities, victims want to believe that someone — anyone — can still fix it. The scammers position themselves as rescuers and use empathy as a tool of manipulation.

They often adopt the language of victim advocacy: “We are fighting for people like you,” “We work with prosecutors,” “We are on your side.” But in reality, their only purpose is to take the last remaining savings of already devastated people. Once the victim pays, the contact ends — and the cycle of shame, silence, and distrust begins again.

The real path to justice

At EFRI, we know that genuine recovery requires time, law, and structure — not empty promises. Together with lawyers, investigators, and litigation funders, we pursue collective actions against payment institutions that enabled the frauds in the first place. Banks and other PSPs are the only one who have the economical power to refund the many victims out there. In addition in our view that is the only way to restore accountability in a system where banks and PSPs have too often turned a blind eye.

We seek damages because the victim’s funds were lost long ago.

If you have been contacted by anyone claiming to have “located your funds” or “secured your refund,” treat it as what it is: a new fraud built on your old pain. No legitimate institution will ever ask you to pay a fee upfront to access money that is supposedly yours.

Conclusion

The essence of every recovery scam can be reduced to one sentence — the lie that starts it all:

Once you hear that, stop the conversation. Document everything. And report it.

Only by exposing these networks publicly can we prevent victims from being deceived twice.