Is the Blockchain a Clearing System?

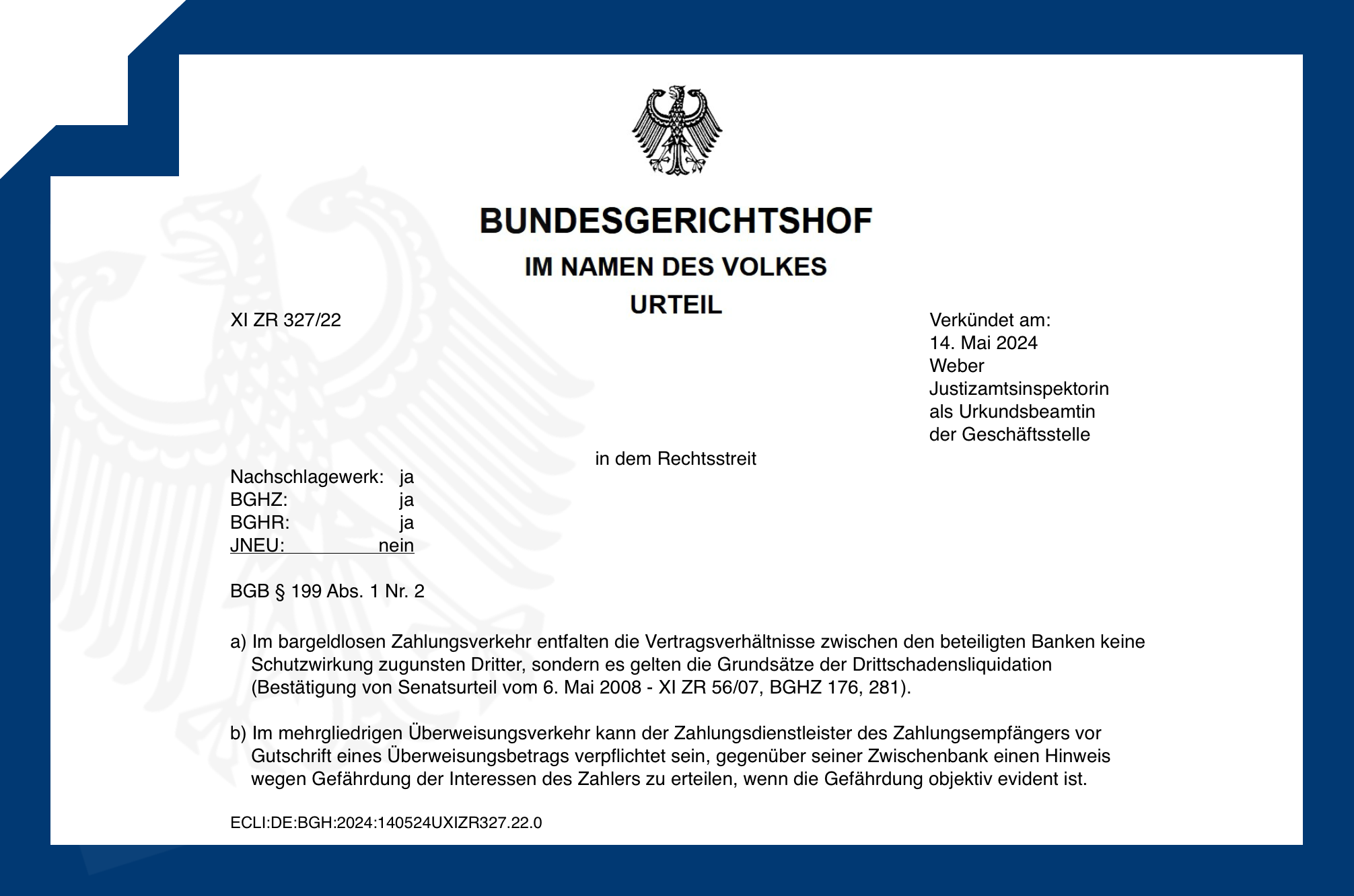

The digital-asset market is slowly running into exactly the same legal questions that have shaped traditional payment law for decades: Who is liable when an inter-exchange transfer fails, is misrouted, or reaches a blocked address? Can doctrines like the Drittschadensliquidation (DSL, third-party damage liquidation) – developed in German banking law