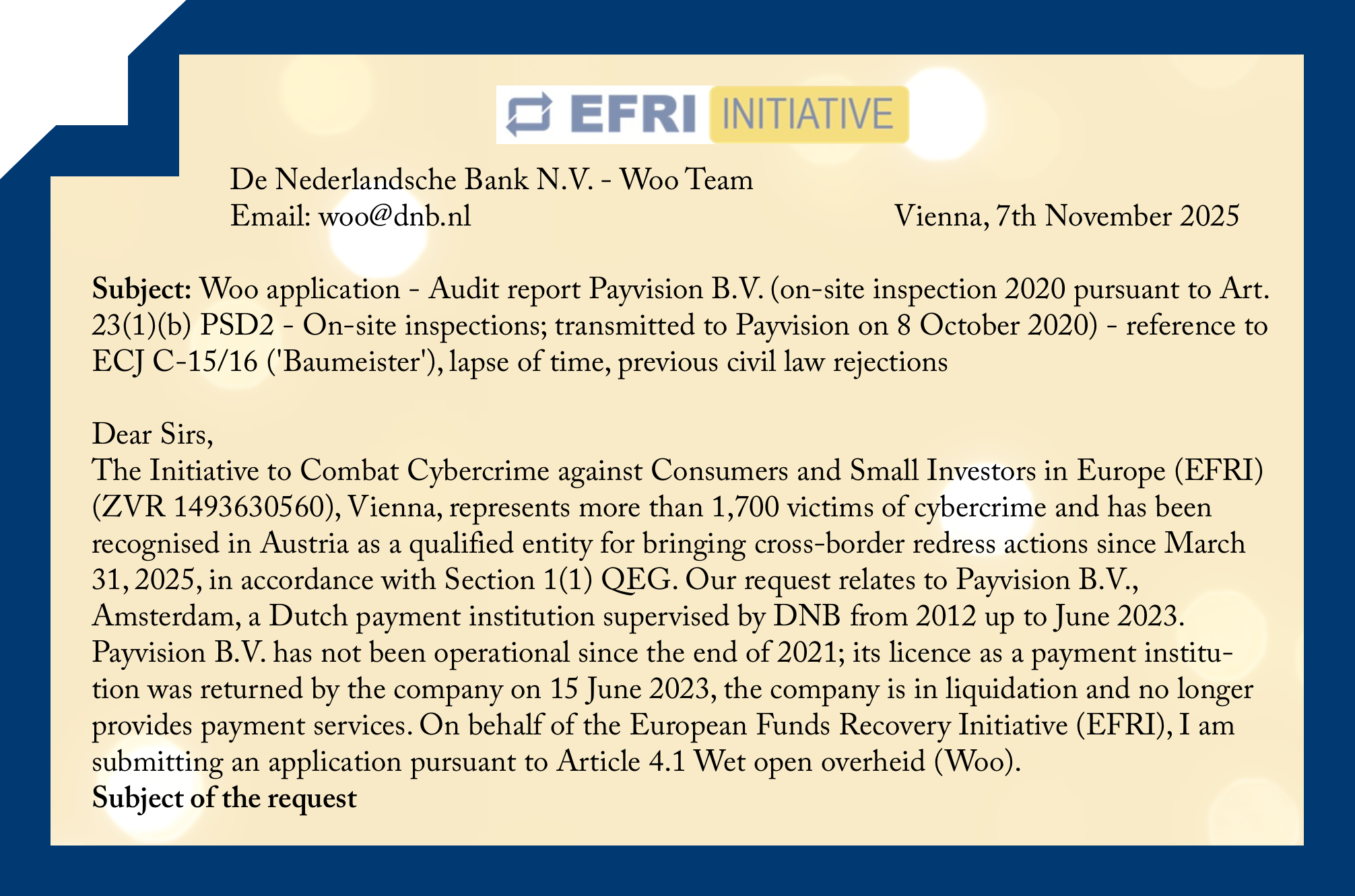

Recovery Scammers Are Impersonating EFRI Again

In the past days, we have received multiple reports that criminals are once again abusing the name European Funds Recovery Initiative (EFRI) to run classic recovery scams. Victims have forwarded emails claiming to come from “EFRI Department” and promising that large sums are “ready for payout” once the victim pays a