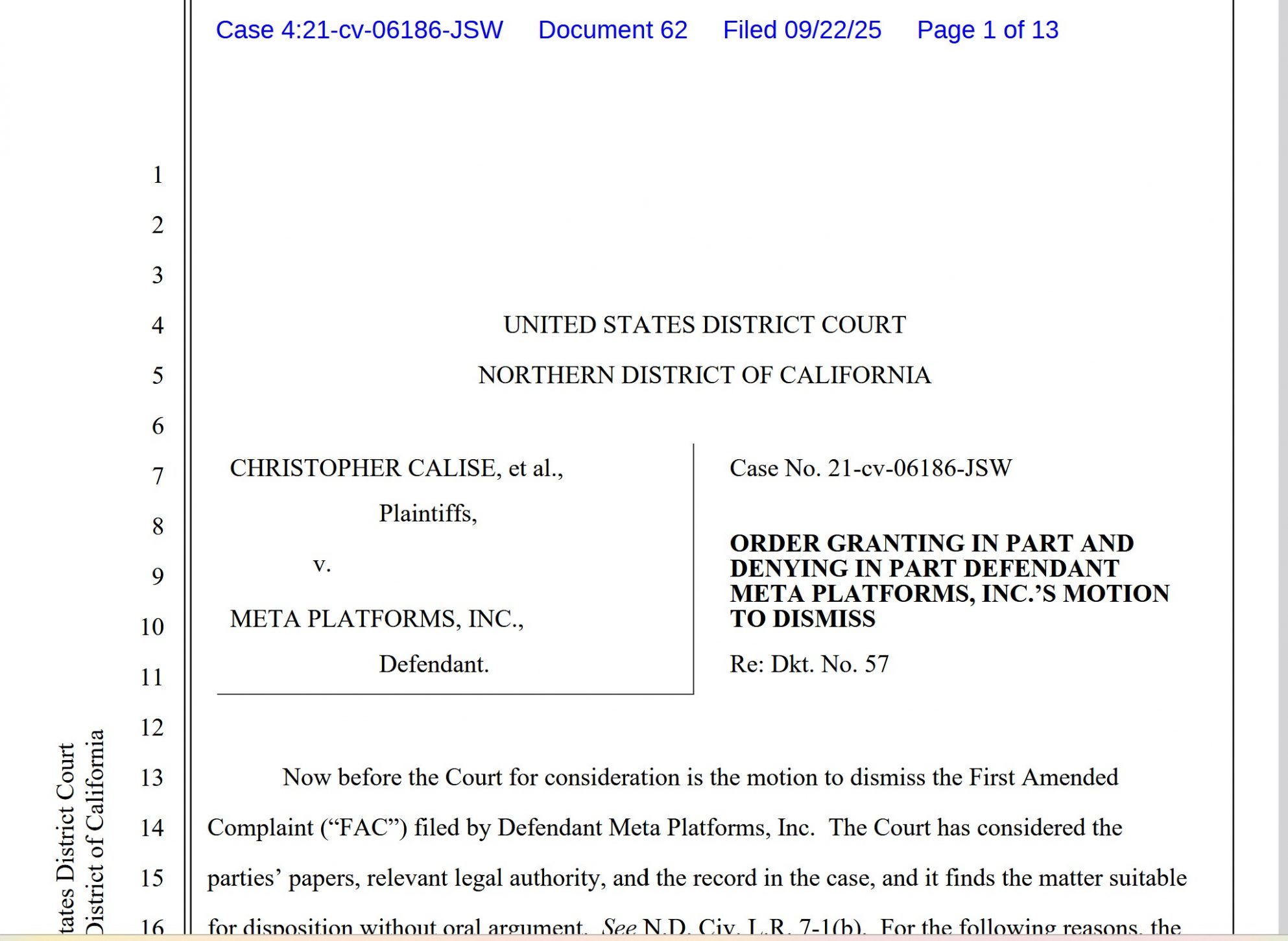

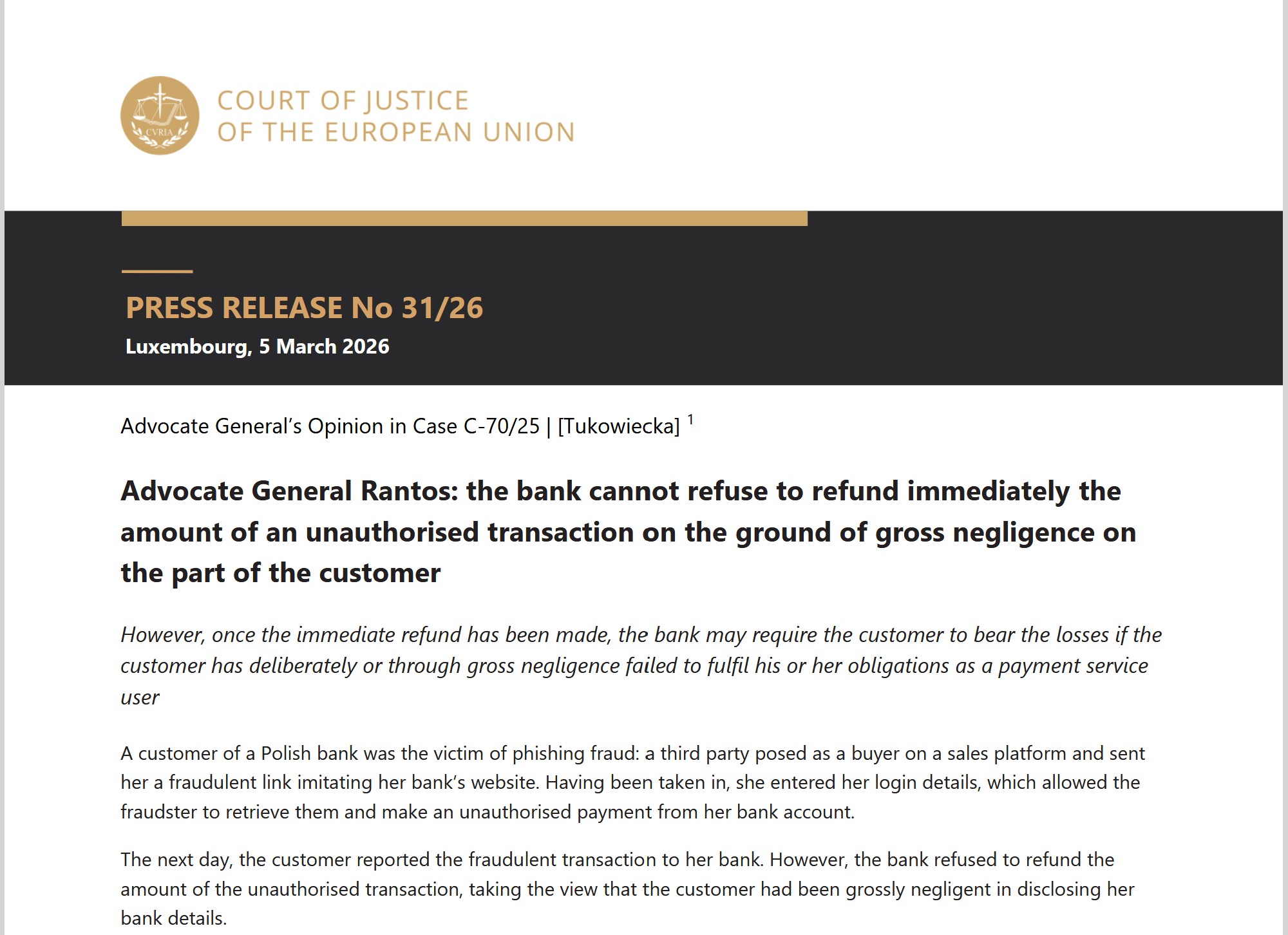

CJEU Case C-70/25: Advocate General Says Banks Must Refund Phishing Victims Immediately

On 5 March 2026, Advocate General Athanasios Rantos delivered his Opinion in Case C-70/25, Tukowiecka, a case that could become highly important for victims of online banking fraud across the European Union. According to the Court of Justice press release, the Advocate General’s position is clear: a bank cannot refuse