At EFRI, we are contacted almost daily by victims of online investment scams who have been pushed into “investing” in crypto assets. The pattern is always the same: first, victims are convinced to invest in crypto – they either buy crypto on the scammers’ instructions or transfer existing crypto assets directly. Then the coins, Bitcoin, Ethereum, or other tokens, are rapidly moved across multiple wallets and exchanges before they are cashed out within hours or days, ending up in the pockets of offshore scammers.

The losses are often devastating – 50,000 EUR, 100,000 EUR, 250,000 EUR or more. Many of these victims are desparate after losing all their money and come to us with the same question:

“Can we not simply freeze the coins at the exchange and then get my money back?”

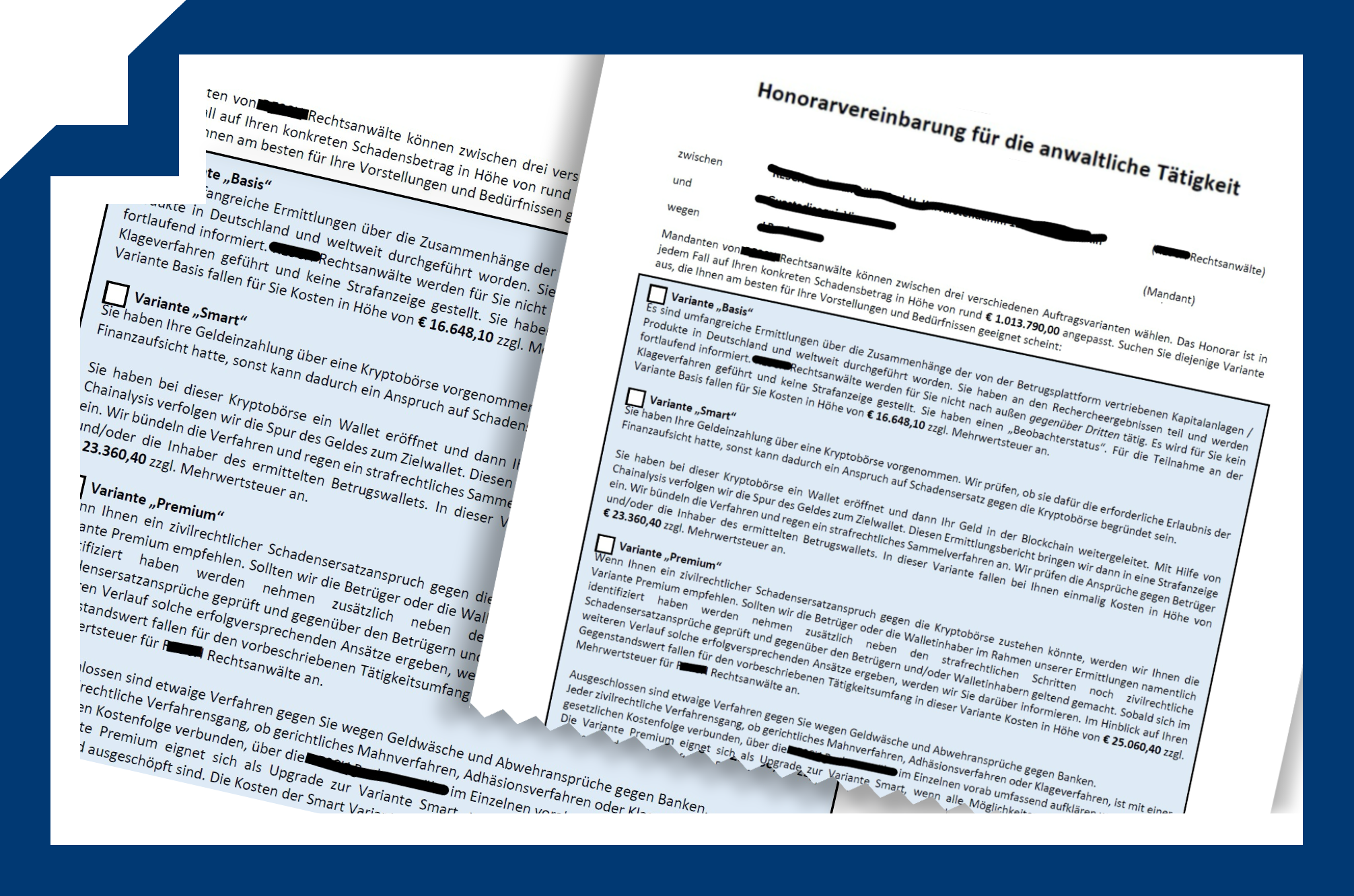

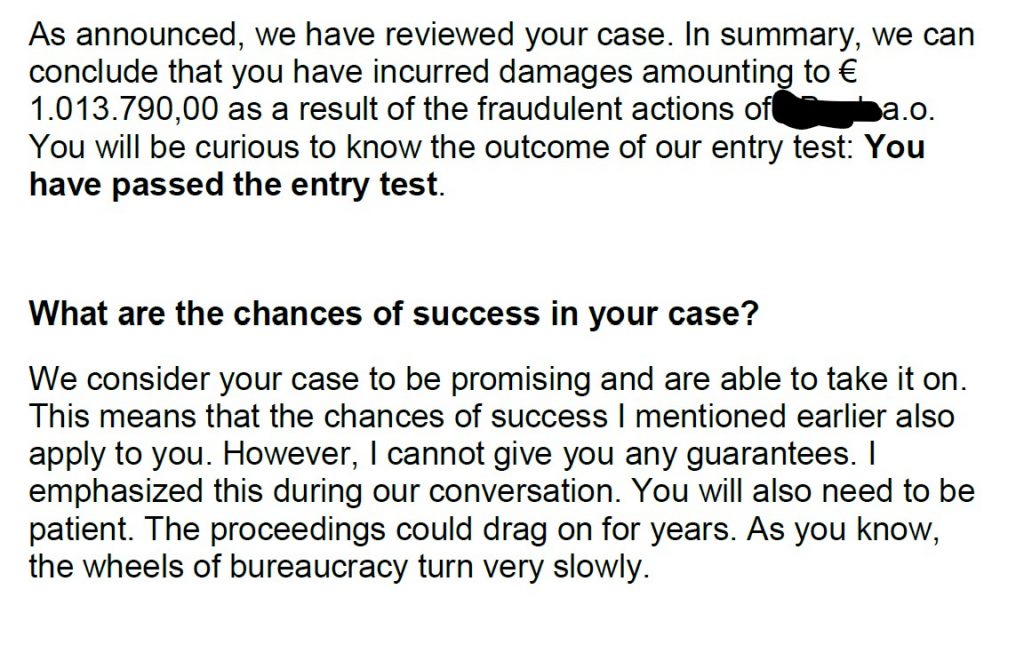

At the same time, we see more and more recovery lawyers promoting exactly this idea. They advertise lawsuits against crypto exchanges located outside the EU, promising to “recover the money” – but only if the victim pays very substantial retainers and legal fees upfront.

EFRI has so far made a deliberate decision not to take on such individual crypto cases. This is not because we do not care. It is precisely because we take consumer protection seriously.

Freezing a wallet is not the same as getting your money back

Recent case law, especially from Great Britain, the Netherlands, shows that it is often possible to obtain court orders against (very often offshore) crypto exchanges. Courts may order exchanges to freeze specific wallets and to disclose customer identification data. Procedurally, this is often “easy” because offshore crypto exchanges simply do not appear in court. From a rule-of-law perspective this is an important step: it proves that crypto is not “untouchable” and that exchanges cannot hide forever behind anonymous wallets.

However, it is crucial to understand what such orders do not achieve.

A freezing order only means that the assets cannot be moved for a certain period of time. It does not mean that the victim will automatically get their money back. Several problems remain:

The balance in the frozen wallet is usually much lower than the total damage suffered by all victims. As scammers know very well about the risk of freezing orders. If twenty victims have been defrauded, but the wallet only contains a small remaining amount, the “pot” is simply too small.

Fraudsters may already have moved the vast majority of the money to other wallets or cashed out through other channels. The frozen amount may be only a fraction of the damage.

The exchange itself might run into financial difficulties, be poorly regulated or located in a jurisdiction where enforcement of foreign judgments is very difficult or extremely expensive.

Even if a wallet is frozen, victims still need:

a judgment against the fraudsters or the exchange, and

successful enforcement of that judgment against exactly those frozen assets.

The distance between “we have a freezing order” and “the victim has money back in their bank account” is very large. It can entail substantial legal costs and significant enforcement risks.

From a strictly economic perspective, for many victims the equation looks like this:

Very high additional costs + very uncertain outcome =

a high risk of losing even more money.

Why EFRI does not take on individual crypto recovery cases

EFRI was created to stand on the side of victims. That includes a duty to protect them from a “second round” of losses – this time through unrealistic legal strategies that are economically not viable.

In most crypto cases, serious recovery litigation is:

Extremely expensive.

It usually involves cross-border jurisdiction issues, specialized counsel in more than one country, blockchain tracing reports, translations, and sometimes parallel proceedings in civil and criminal courts. It is easy to reach five-figure legal budgets long before there is any realistic prospect of a recovery.Legally uncertain.

Fraudsters are often anonymous or reside in countries where legal enforcement is impractical. Many exchanges are registered in non-EU jurisdictions, protected by aggressive terms and conditions, complicated corporate structures and sometimes opaque regulatory regimes. Legal theories of liability – such as negligence, unjust enrichment or special duties of care – may be arguable, but they are far from guaranteed.Economically questionable.

Even if there is a theoretical legal route, the real question is: after paying all lawyers, experts and court fees, what remains net in the victim’s hands? In many scenarios, the honest answer is: not very much, and in most cases nothing at all.

As a consumer protection organization, we refuse to pretend that a highly uncertain and extremely costly route is a “solution” just because it is legally conceivable.

This is why we have taken the clear position:

We do not routinely take on individual crypto loss cases,

if the foreseeable legal costs and enforcement risks are completely out of proportion to the realistic recovery. prospects.

We know that this is painful to hear. But it is, in our view, more honest than raising expectations that are unlikely to be fulfilled.

Why we are critical of expensive lawsuits against offshore exchanges

Alongside genuine attempts to help victims, we see an emerging business model: lawyers and intermediaries who advertise “special action” against crypto exchanges located in non-EU countries. The marketing is often very optimistic. Victims are told that there are “good chances” to recover their investments if they join these actions.

What is usually not highlighted with the same clarity are the risks and limitations:

Weak or contested legal basis

Exchanges regularly argue that they are only technical intermediaries, that they did not know about the fraud, and that all risks were disclosed in their terms and conditions. This does not mean they can never be held liable. But it does mean that such cases are complex, highly contested and far from certain.

Enforcement in third countries is difficult and costly

Even if a court in an EU country or elsewhere issues a judgment against an offshore exchange, it still has to be recognized and enforced in the jurisdiction where the exchange (or its assets) are located. This often requires additional procedures, local lawyers and further expenses. A favorable judgment on paper is not the same as cash in the victim’s account.Worst case: victims lose again

The worst outcome – and sadly a realistic one – is that victims pay 10,000–20,000 EUR or more for legal fees and expert reports, some interim measures are obtained, perhaps even a judgment is issued, but in practice there is no effective recovery. In such a scenario, the victim is not only still without the original investment, but now also burdened with heavy legal costs.

From a victim-oriented perspective, it is extremely problematic to present such litigation as a “promising recovery strategy” without also clearly explaining all these economic and practical obstacles.

EFRI therefore views many of these high-cost actions against offshore exchanges with great skepticism. We see a serious risk that already traumatized victims are once again used as a revenue source – this time in the legal system rather than by fraudsters

What EFRI does – and what we do not do – in crypto cases

Because this topic is so sensitive, we want to be very clear:

What we do not do:

We do not take on individual mandates whose main strategy is to sue crypto exchanges in non-EU countries with very high upfront costs and very uncertain enforcement prospects.

We do not recommend or promote lawyers who sell expensive “miracle solutions” based on highly optimistic assumptions about offshore litigation.

What we do instead:

We explain openly where the legal and economic limits lie.

We tell victims when the cost–benefit ratio is, in our view, simply not reasonable.We warn about re-victimization through unrealistic recovery offers – including those that come from seemingly reputable legal actors.

We work on the political and regulatory level to push for better rules and shared liability frameworks for payment providers, banks and platforms, so that future victims are better protected and fraud is less profitable.

In rare and very specific constellations – for example where there is a strong EU nexus, a clearly identifiable institution within the EU and a realistic collective action strategy, we may consider a broader, structured approach (similiar the approach we apply for the Payvision civil case). But these are exceptions, not our default.

Our conclusion – uncomfortable honesty instead of false hope

Victims of crypto investment scams have already lost a great deal: their savings, their trust and often their psychological stability. We believe that our duty as a consumer organization is not only to denounce the fraudsters, but also to protect victims from losing even more in the search for justice.

For this reason, our position is:

In most individual crypto loss cases,

pursuing high-cost litigation against non-EU exchanges is not economically sensible for retail victims.

As painful as it is, we would rather say “this does not make sense”

than sell false hope at a high price.

We know this is not the message many victims want to hear. But we consider transparent, realistic communication more respectful than encouraging them to pour their remaining resources into legal strategies that are unlikely to deliver a positive net outcome.

If you have lost money in a crypto-related investment scam, EFRI can provide you with information, context and warnings about further risks – especially so-called recovery scams and overly optimistic legal offers.

Overly optimistic legal offers like the following example – an excerpt from a recent proposal to a crypto fraud victim whose money ended up at an offshore crypto exchange that had already shut down by the time the victim contacted the German law firm:

What we will not do is to promise you a rescue path that, from our experience and analysis, is more likely to deepen your financial and emotional loss than to repair it.