At the end of January 2019, Gal Barak, the owner of several investment scam websites, including XtraderFX, OptionStars/OptionStarsGloball, Safemarkets, and Golden Markets, was arrested by law enforcement agencies in Austria and Germany. Barak, an Israeli citizen, was apprehended in Bulgaria at the request of Austrian authorities due to his involvement in a large-scale financial fraud operation that defrauded thousands of small investors across Europe.

In September 2020, Barak was sentenced to four years in prison by an Austrian court for severe commercial fraud and money laundering. The court found that he manipulated trading software and led a cybercrime organisation that targeted unsuspecting investors, particularly retirees, resulting in losses exceeding €200 million globally.

Despite his conviction, Barak has not yet made any restitution payments to the victims of his schemes.

Since the beginning of 2019, EFRI has been supporting victims of Barak. More than 360 victims have signed on with EFRI to pursue refunds from the scammers or their enablers since January 2019.

What companies enabled BARAK to scam tens of thousands of consumers?

Gal Barak’s fraudulent schemes involved several payment processors that facilitated the movement of illicit funds through various online trading platforms. The key processors identified in connection with Barak’s operations include:

Payvision B.V. – This Amsterdam-based payment service provider processed a significant volume of transactions related to Barak’s fraudulent activities, totalling approximately €75.6 million from 2016 to 2019. Payvision B.V. enabled the acceptance of credit card payments for multiple scam websites, including XTraderFX, OptionStarsGlobal, SafeMarkets, and Golden Markets. Despite high chargeback rates from defrauded victims, Payvision B.V. continued its operations with Barak’s companies, indicating a lack of due diligence regarding the nature of these transactions.

Connectum Ltd.: This London-based payments facilitator was implicated in handling over €7 million in proceeds from Barak’s scams between 2017 and 2019. Connectum served as an intermediary for transactions associated with Barak’s fraudulent websites, processing payments through accounts held in Germany and Latvia. Although Connectum claimed no direct affiliation with Barak’s schemes, it acknowledged that transactions were facilitated by a third-party processor registered in the UK.

Investbank: Many of the shell companies associated with Barak maintained accounts at Investbank in Bulgaria. Reports indicated that large sums of money were transferred rapidly through these accounts, often without proper oversight or compliance with anti-money laundering regulations. This bank reportedly had a lax approach to monitoring suspicious transactions, which allowed Barak and his associates to withdraw substantial amounts of cash without prior requests.

These payment processors played crucial roles in enabling the financial infrastructure that supported Barak’s extensive network of fraudulent investment schemes, ultimately defrauding thousands of investors across Europe.

Legal responsibility for fraud!

Through their facilitation of card payments for scammers, Payvision B.V. and CONNECTUM Ltd. assumed liability for the fraud and subsequent bankruptcies of the companies they had accepted onto their platforms.

EFRI's legal actions against Payvision B.V.!

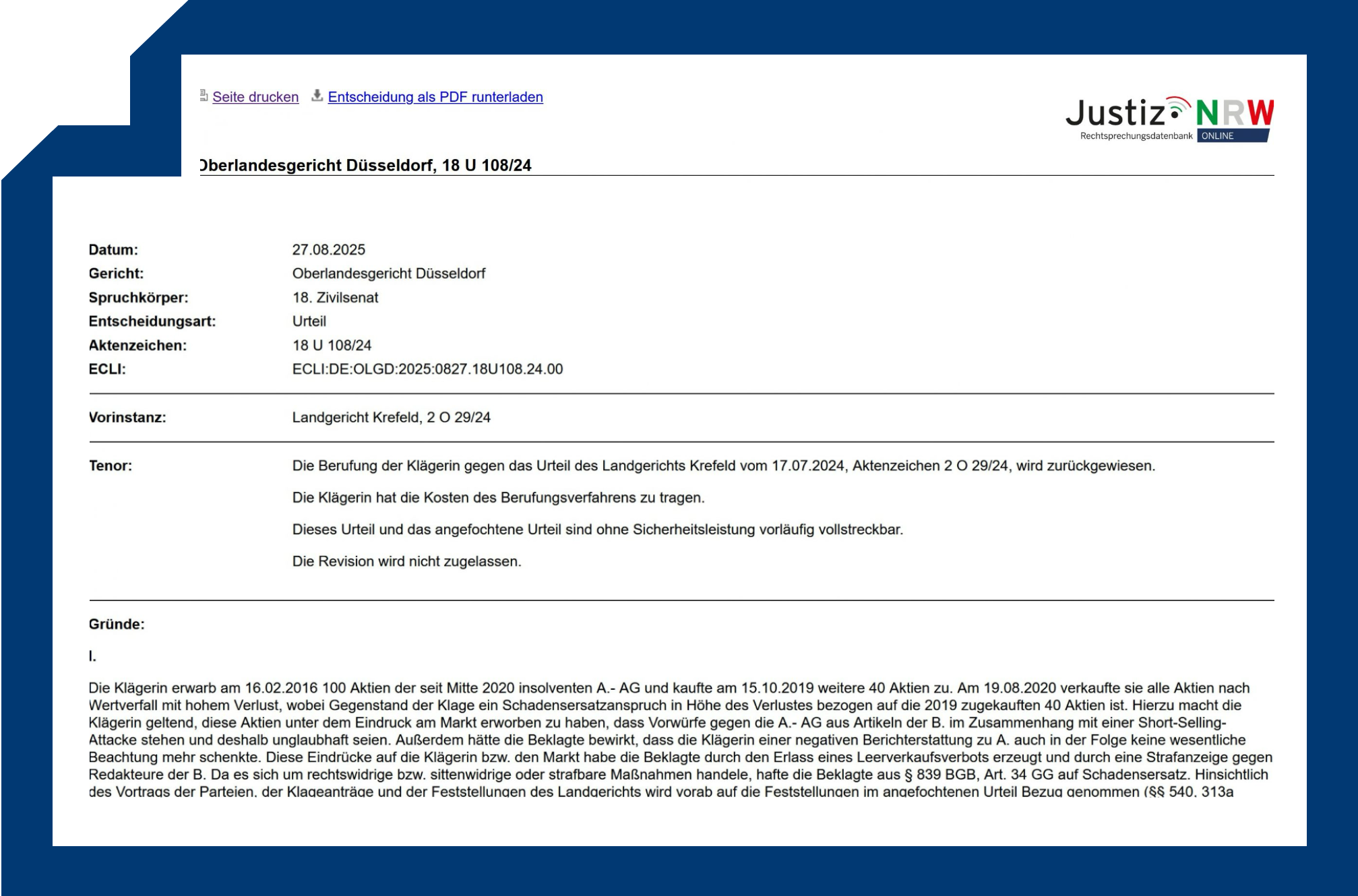

Over the past few years, we have taken numerous actions against Payvision B.V. You can read about all our actions taken against them here. It was challenging as ING Group N.V., the owner of Payvision B.V. up to today, refused to go legally against the ex-CEO of Payvision (Rudolf Booker). ING Group N.V. is covering up the case. Interestingly, the current CEO, Steven van Rijswijk, was responsible for compliance and risk management when ING Bank N.V. acquired Payvision in early 2018.

Due to ongoing discussions with victims, we are aware that many of Gal Barak’s victims are suffering from old-age poverty and severe illness as a result of the fraud and the loss of their life savings.

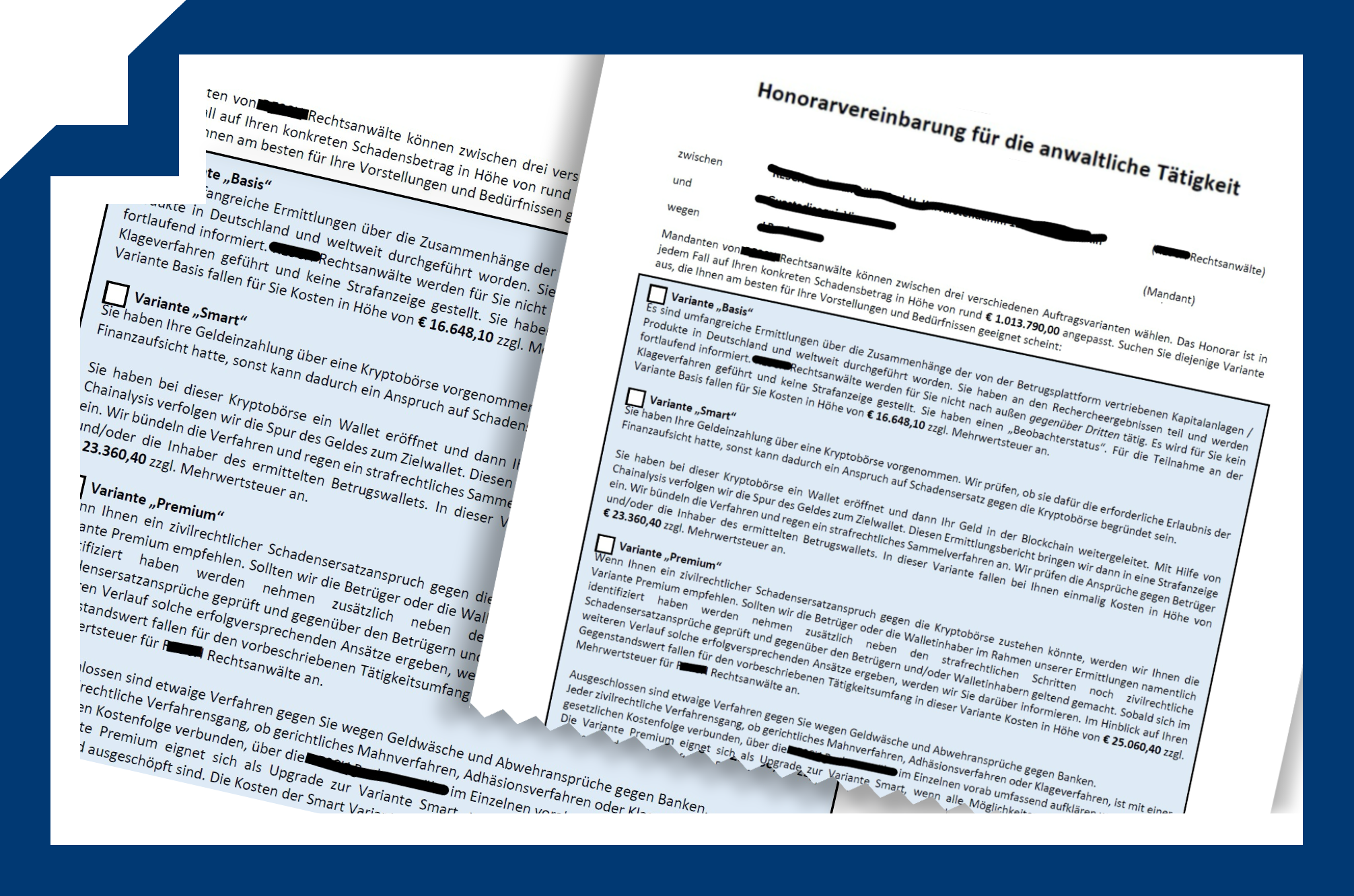

If you would like to join our case to seek a refund, please be aware that we will need to see your deposit slips showing the transactions with the scammers. If you no longer have access to this information, please still come forward; we will do our best to assist you. (Note: we only ask for a success fee!)